ACCOUNT TYPES

Why Do We Have Multiple Account Types ?

At Fortuna Markets, we offer multiple account types to cater to the unique needs of our traders. Each account type is carefully crafted to provide distinct advantages and features, enabling you to choose the one that best aligns with your trading goals and risk tolerance. Whether you are a novice looking for a friendly introduction to forex or a seasoned trader seeking advanced tools and personalized support, our range of account types ensures that you have the flexibility and resources to trade with confidence and success. Join us today and experience the power of choice as you embark on your forex journey with a broker that prioritizes your trading aspirations.

Flexible Leverage Options

Tailor your trading strategy with our account types offering flexible leverage. Choose the leverage that suits your risk appetite, from conservative to aggressive, empowering you to manage your positions effectively.

Risk Management Tools

Our account types come with built-in risk management tools, such as stop-loss and take-profit orders, allowing you to protect your capital and lock in gains.

Diverse Range of Instruments

Our account types provide access to a diverse range of financial instruments, including major, minor, and exotic currency pairs, as well as commodities, indices, and cryptocurrencies. Trade multiple assets from a single platform

Loyalty Programs

Our account types offer exclusive loyalty programs, rewarding frequent traders with various benefits, rebates, and bonuses.

Complete Package For Every Traders

Bronze

The “Bronze Account” suggests limitless possibilities and infinite potential, appealing to traders who aim for long-term growth and success.

Commission: ZERO

Swap: FREE

Spread: From 1.8 pips

Stop out: 20%

Margin Call: 70%

Max Lot/Position: 30

Hedge: 100%

Expert: Allowed

Silver

The “Silver Account” conveys strength, durability, and resilience, highlighting robust features and enhanced trading capabilities.

Commission: 3$ / Lot

Swap: Yes

Spread: From 0.5 pips

Stop out: 50%

Margin Call: 100%

Max Lot/Position: 30

Hedge: 100%

Expert: Allowed

Gold

The “Gold Account” implies the highest level of excellence and superiority, offering an all-encompassing trading experience with unrivaled benefits and privileges.

Commission: 5$ / Lot

Swap: Yes

Spread: From 0.1 pips

Stop out: 50%

Margin Call: 100%

Max Lot/Position: 30

Hedge: 100%

Expert: Allowed

Features of Our Account Types

Competitive Spreads

CS refer to the narrow difference between the bid and ask prices in trading, offering traders a cost-effective and competitive environment for executing trades.

Fast Execution

Experience lightning-fast trade execution with minimal slippage, ensuring that your trades are executed at the best available prices.

Personalized Support

We value every trader, and our account types come with personalized support to cater to your specific needs.

Frequently Asked Questions

Fortuna Markets offers a diverse range of trading accounts to suit the needs of different traders, including Bronze, Silver, and Gold accounts. Each account type comes with its unique features and benefits, such as varying spreads, leverage options, and minimum deposit requirements.

Yes, Fortuna Markets encourages clients to practice trading with a demo account that simulates real market conditions without any financial risk. This allows traders to familiarize themselves with our trading platforms and refine their strategies.

The minimum deposit varies by account type. For a Bronze account, the minimum deposit is $100, while Silver accounts require $1000, and Gold accounts necessitate a higher initial deposit of $5,000.

Fortuna Markets prides itself on transparency. There are no hidden fees for account maintenance. However, some accounts may incur fees on overnight positions, known as swap fees, and inactivity fees may apply if an account is not used for an extended period.

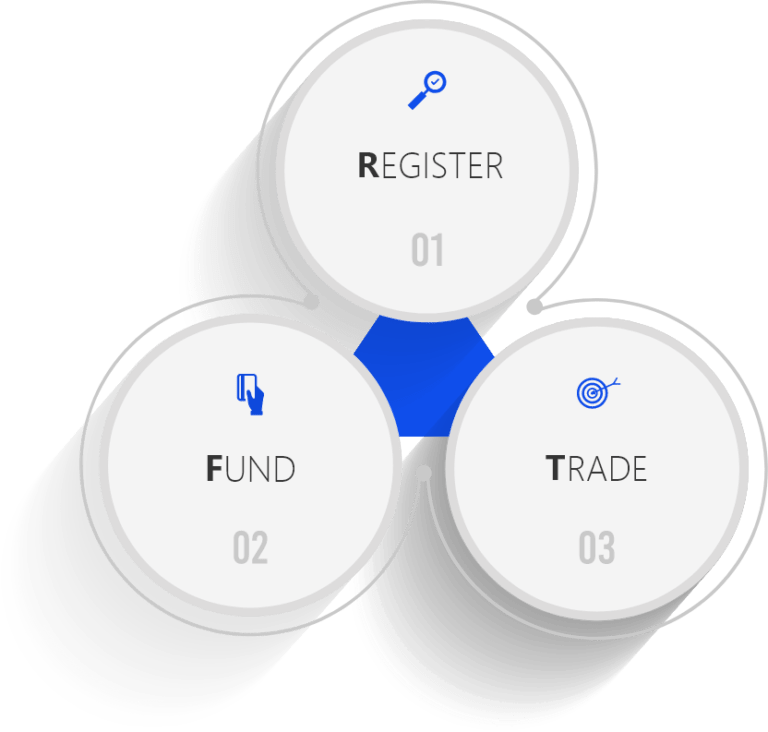

Funding your Fortuna Markets account can be done through various methods, including bank wire transfers, credit/debit cards, and selected e-payment platforms. All transactions are safeguarded with industry-standard security measures.

Certainly. Fortuna Markets offers comprehensive support for all our clients. Our customer service team is available 24/5 to assist with account setup, management, and any other inquiries you may have.