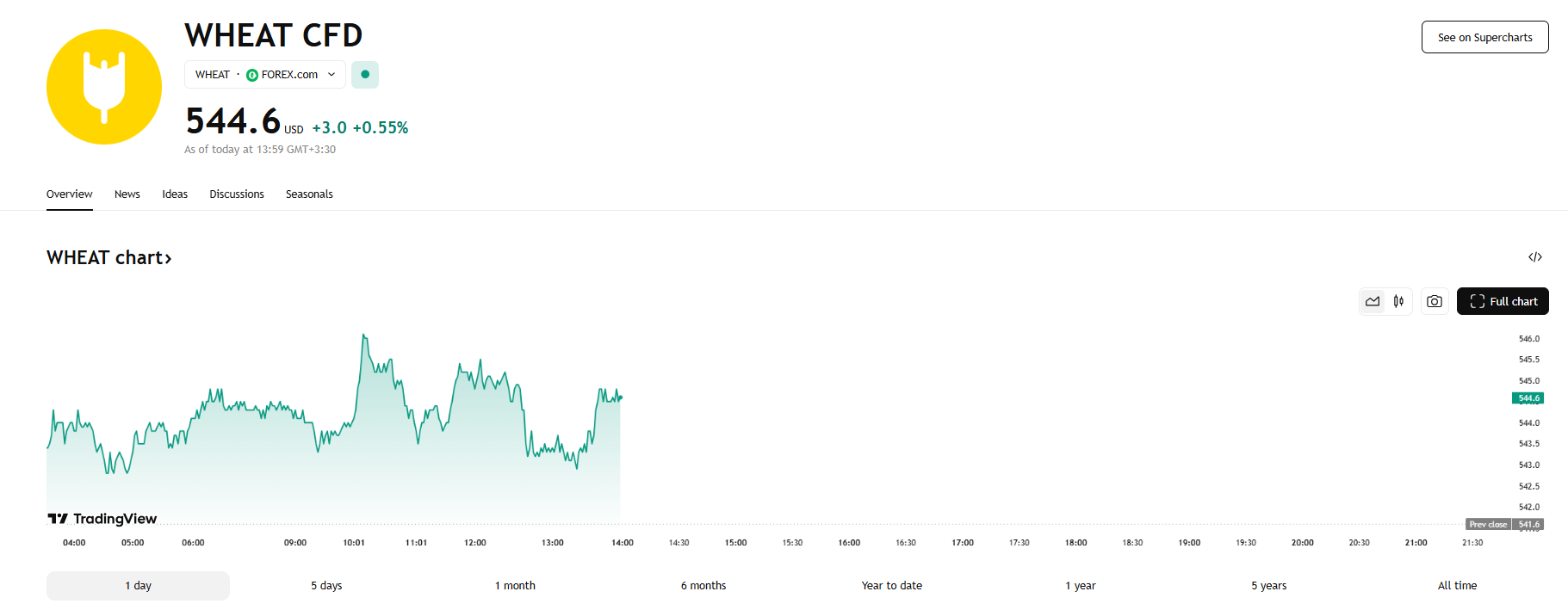

The wheat symbol in forex is represented by the trading code WHEAT. This symbol reflects the price of wheat per bushel in terms of US dollars and is widely traded in global commodity and CFD markets. Traders can speculate on wheat price fluctuations using this symbol, either through futures or CFDs.

Wheat has been traded for centuries, but today it is accessible on modern forex and commodity platforms under global standards. As a crucial agricultural product with strategic importance, wheat prices are highly influenced by weather conditions, global demand, and export policies—making the WHEAT CFD symbol a volatile and attractive option for traders.

🔵Trading Conditions for the WHEAT Symbol in Forex

Trading the WHEAT symbol in financial markets is subject to specific trading conditions that may vary depending on the broker and account type.

However, common conditions include:

- Spread: Ranges between 30 and 70 pips depending on market liquidity

- Commission: Typically from $2 to $6 per lot for Raw/ECN accounts

- Minimum Trade Size: Usually starts from 0.1 lots

- Leverage: Generally between 1:20 and 1:50 for agricultural commodities

- Liquidity: High during U.S. market hours and agricultural report releases

WHEAT chart on the TradingView

🔵Top Strategies for Wheat Trading in Forex

- Breakout Strategy: Wheat often trades within defined ranges, and a breakout can signal a new trend.

- RSI + Candlestick Patterns: Combining RSI with reversal candlesticks can provide reliable entry points.

- Agricultural Fundamentals: Follow USDA reports, weather forecasts, and geopolitical news affecting wheat supply.

- News-Based Trading: Pay attention to global stockpile data and export figures for potential market shocks.

- Volume Analysis: Use volume indicators to confirm trends and avoid false breakouts.

🔵Best Time to Trade the Wheat Symbol

The best time for wheat trading in forex is during the New York session, especially between 13:30 and 17:00 GMT when CME commodity markets are most active.

This period offers the highest trading volume, tighter spreads, and better opportunities for both technical and fundamental traders.

🔵Pros and Cons of Trading WHEAT in Forex

Pros:

- Diversifies trading portfolios with agricultural commodities

- Medium-to-high volatility for short-term and swing trades

- Access to fundamental data from official sources like USDA

Cons:

- Heavily affected by climate conditions and geopolitical factors

- Lower leverage compared to major forex pairs

- Wider spreads on some platforms

🔵Final Words

The WHEAT symbol in forex represents a valuable opportunity for traders seeking exposure to agricultural markets. Given its global economic importance, understanding trading conditions, leveraging combined strategies, and trading during optimal hours can help maximize profitability and minimize risks.

If you’re interested in trading wheat in the financial markets, our experts can provide you with the right guidance to access the best trading conditions.

🔵Frequently Asked Questions

What is the wheat symbol in forex markets?

It’s represented by WHEAT, indicating the global price of wheat per bushel in US dollars.

Do I need a special account to trade wheat CFDs?

Not necessarily, but using Raw or ECN accounts is recommended for lower spreads.

Is wheat liquid enough for active trading?

Yes, especially during U.S. session hours and major agricultural report releases.