The US Dollar Index symbol in forex, known by its codes USDX or DXY, is a benchmark for measuring the value of the US dollar against a basket of six major world currencies. It was introduced in 1973 following the collapse of the Bretton Woods agreement and has since become a key tool for assessing the strength of the dollar in global markets.

The index consists of the euro (57.6%), Japanese yen (13.6%), British pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%), and Swiss franc (3.6%). Due to the euro’s high weight, changes in the EUR/USD pair significantly impact the index.

🔵Trading Conditions of the US Dollar Index Symbol in Forex

The DXY symbol in forex is typically traded via CFDs or futures contracts. Conditions vary depending on the broker, but in general:

- Spread: Ranges from 0.5 to 1.5 pips.

- Commission: Many brokers offer zero commissions, though some charge $1–$3 per lot.

- Leverage: Up to 1:500 depending on broker and account type.

- Trading Hours: 24/5 from Monday to Friday.

In the ICE futures exchange, each USDX contract represents 1,000 times the index value. For instance, if the index is at 97.450, the contract value would be $97,450. The minimum price fluctuation is 0.005, equivalent to $5 per contract.

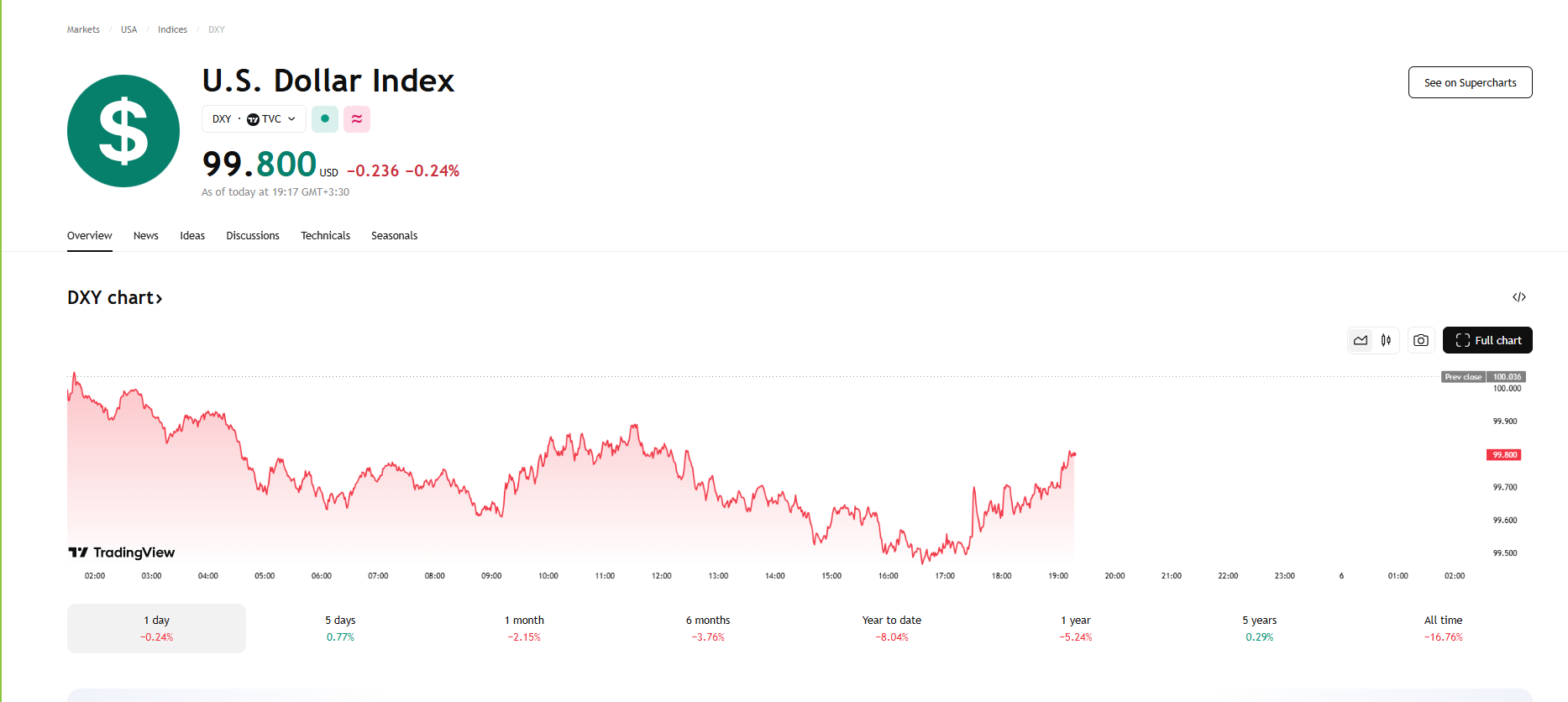

View Live DXY Chart on TradingView

🔵Best Strategies for Trading the US Dollar Index Symbol in Forex

- Breakout Strategy: Identify key support and resistance levels and enter positions when price breaks these levels.

- Mean Reversion Strategy: Use moving averages to spot deviations from average price and potential reversals.

- Correlation Strategy: Analyze correlation between USDX and pairs like EUR/USD to anticipate price movement.

- Fundamental Analysis: Monitor economic reports and Fed decisions that influence USD value.

🔵Best Time to Trade the US Dollar Index Symbol in Forex

The best time to trade the US Dollar Index symbol in forex is during the overlap of the London and New York sessions, from 13:00 to 17:00 GMT. This window provides the highest liquidity and volatility, offering more trading opportunities.

🔵Pros and Cons of Trading the US Dollar Index Symbol in Forex

Pros:

- Provides a comprehensive gauge of USD strength against multiple currencies

- Effective tool for hedging dollar exposure

- High liquidity and competitive spreads

Cons:

- Highly sensitive to economic and political news

- Requires deep understanding of fundamental and technical factors

- May be complex for beginner traders

🔵Final Words

The US Dollar Index symbol in forex (USDX) is a powerful instrument for evaluating and trading the USD against major global currencies. With a clear grasp of its structure, trading conditions, and effective strategies, traders can use it to enhance market analysis and risk management.

If you’re interested in trading USDX in the financial markets, our experts can provide you with the right guidance to access the best trading conditions.

🔵Frequently Asked Questions

What is the US Dollar Index symbol in forex?

The US Dollar Index, represented by USDX or DXY, measures the USD’s value against a basket of six major currencies.

How can I trade the DXY symbol in forex?

Through CFDs on trading platforms or via futures contracts on the ICE exchange.

When is the best time to trade the US Dollar Index symbol?

During the London–New York session overlap from 13:00 to 17:00 GMT.