Forex, often known as the Foreign Exchange Market, is a decentralized worldwide financial market. This market serves as one of the world’s major financial marketplaces, defining the exchange rate across all currencies. The Forex market facilitates the trading and exchange of one currency for another. However, tradable assets in the Forex market are introduced and explained below:

Tradable assets in the Forex market

This is the actual currency transacted on the Forex markets. Because the money in these marketplaces is not tangible, currency transactions may appear a little complicated.

Since Forex exchange rates differ among two currencies, the values of digital currencies fluctuate regularly. These alterations have created an opportunity for Forex traders to benefit from fluctuations.

Forex trading components:

the major trading components in Forex are as follows:

- Currency pairings: major, minor, and exotic currency pairs

- Metals: gold, silver, etc.

- Power sources: oil and gas

- Commodities: wheat and corn

- Stocks: Apple and Google

- Indexes: Dow Jones and S&P 500

- Bond: US10Y

- Digital currencies: Bitcoin and Ethereum

- ETF: ETF-SPY

Currency pairings traded on the Forex market:

Currency pairings are the most essential trading instruments in the Forex market, with the highest number of transactions. The price ratio of two currencies from different nations is referred to as a “currency pair.” The value of each nation’s currency varies from one another and is determined by a variety of factors, such as political, living, and commerce conditions, among others. In the Forex market, currency pairings are classified into three types:

- Major currency pairs

- Minor currency pairs

- Exotic currency pairs

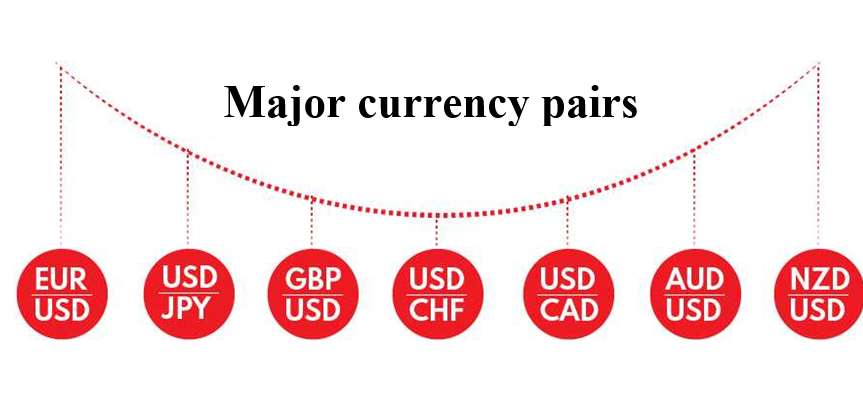

Major currency pairs:

On the Forex market, the main or major currency pairs account for the majority of trades. On the Forex market, a large number of traders are involved in trading the major currency pairs, which represent the currencies of advanced nations. One side of each of these currency pairings is the U.S. dollar, while the other is a liquid asset and a strong currency. These currency pairings account for eighty percent of worldwide Forex market transactions, which include:

- EUR/USD (Euros to Dollars)

- GBP/USD (Pounds to Dollars)

- USD/JPY (Dollar to Japanese yen)

- USD/CHF (Dollars to Swiss Francs)

- USD/CAD (US dollar to Canadian dollar)

- AUD/USD (Australian dollar to US dollar)

- NZD/USD (New Zealand Dollar to US Dollar)

Minor Currency Pairs:

Cross-currency or minor currency pairings are currency pairs with a lower trade volume than the major currency pairs. There is no US dollar or USD in any of these currency pairings, which are the currencies of developed countries. The following currency pairings are among the most significant Cross or minor currency pairs:

- EUR/GBP (Euro to Pound)

- GBP/JPY (Pounds to Yen)

- EUR/CHF (Euro to Swiss Franc)

- GBP/CHF (pounds to Swiss francs)

- EUR/CADI (Euro to Canadian Dollar)

Exotic Currency Pairs:

Unusual or exotic currency pairings comprise two currencies, the first of which is a major currency and the other a growing market currency. These currency pairings have a lower trading volume than other currency pairs; therefore, their transaction fees are greater. The following are examples of uncommon currency pairings.

- AUD/MXN (Australian Dollar to Mexican Peso)

- GBP/ZAR (British Pound to South African Rand)

- USD/HKD (US Dollar to Hong Kong Dollar)

- JPY/NOK (Japanese Yen to Norwegian Krone)

- NZD/SGD (New Zealand Dollar to Singapore Dollar)

- EUR/TRK (Euro to Turkish Lira)

Currency Pairs for trading:

Which currency pairings are ideal on the Forex market is among the most essential and often asked topics.

Professionals in the foreign exchange market concentrate mostly on one to three currency pairings out of the total number of Forex currency pairs. On the Forex market, however, your approach is the most crucial component. If you have just recently entered this market, you should seek out currency pairings with the largest trade volume. A high trading volume provides the ability to decrease risk and improve liquidity. Each trader may choose currency pairings and conduct transactions based on parameters such as the kind of transaction, the amount of money, the volume of the transaction, and the risk someone is willing to assume.

Metals in the Forex market

Precious metals, particularly gold, have been seen as a secure investment throughout history. On the Forex market, gold is regarded as “the primary traded metal.”XAG symbolizes gold on the foreign exchange market. You may trade gold in conjunction with currency pairings that are matched with it. In addition to gold, silver is also traded on the Forex markets.

Energy resources in the Forex market

The Forex market trades commodities such as oil, gas, and so on. Crude oil is a commodity that is in high demand for both purchase and sale in the currency market. Over 160 kinds of oil, including OPEC oil, Brent crude oil, West Texas Intermediate oil, and others, are traded on the foreign exchange market. Brent oil and West Texas Intermediate have the highest volume of trade among all other oils. Forex provides real-time oil price charts for WTI crude and Brent crude.

Stock indexes on the Forex market

Important Forex indexes include Nasdaq-100, Dow Jones, etc. Traders use the Dow Jones index as a trustworthy indication or symbol to assess the condition of the American economy according to the performance of their stock portfolio.

Companies controlled by Dow Jones

The Dow Jones index, which consists of the 30 leading and greatest corporations in the American economy, has been empowered to construct its shares. Apple, Tri-M, American Express, Coca-Cola, Microsoft, etc. are some of the corporations included in the Dow Jones index.

Commodity in the Forex market

The commodity or products market is a venue for purchasing and selling raw materials and raw goods, and it affects Forex currency pairings both directly and indirectly. Additionally, Forex brokers had already made it feasible to trade a variety of items. In brokers, it is possible to trade oil and different metals, for instance. On the foreign exchange market, items fall into two categories: soft goods and hard goods.

Soft goods: The term refers to livestock and agricultural products. Examples of soft products include wheat, maize, sugar, soy, beef, and coffee.

Hard goods: The term “hard goods” refers to items that exist in nature. Similar to the extraction of oil and gold from the earth

Precious metals, energy resources, and commodities or goods are the sorts of products in the foreign exchange market. Overall, on the foreign exchange market, hard commodities are often divided into two categories: metals and energy, whereas soft commodities are grouped together under the term “goods.”

How does the currency symbol appear in Forex?

In Forex, currency symbols are always made up of three letters. The first two letters of the sign represent the country’s name, while the final letter represents the name of the country’s currency. This is generally the initial letter of the country’s currency. These three letters are referred to as ISO 4217 currency codes.

For example, in USD. The letters US and D stand for the United States of America and the dollar, respectively.

Understanding currency nicknames is critical. It is significant since these nicknames are used in numerous English-language analyses.

The Forex market’s key to success

A thorough comprehension of the tradable assets in the Forex market, enough research, and acquiring complete information from the list of Forex currency symbols constitute half of this market. The most significant aspect is your job experience in this area. We want to reap the benefits of all financial markets. You must understand when it is optimal to purchase and sell currencies in order to maximize your profits. As a result, understanding the behavior of currency trends may significantly improve your revenue in the financial markets. You may easily predict the future of a chart by observing its history. Instead of making further transactions and increasing the risk, strive to generate a solid profit with accurate knowledge.

The last word

We attempted to clarify tradable assets in the Forex market in this article. Additionally, study all forms of currency pairings from various perspectives and present the best currency pairs in the Forex market.

The Forex market has ups and downs and often demands significant knowledge and expertise. More than 85 percent of the market’s volume is comprised of major currency pairings. Newcomer traders are encouraged to trade with the major currency pairings. Also, familiarize oneself with two forms of technical analysis and fundamental analysis so they may make more accurate and prudent trades.

Ultimately, keep in mind that to choose the best currency, you must first assess your risk aversion and level of expertise and then select the best currency based on your strategy.