The Platinum symbol in Forex, denoted as XPTUSD, represents the value of one ounce of platinum quoted in US dollars. On most trading platforms, it appears as XPT/USD and is considered one of the valuable instruments among precious metals in the forex market.

Platinum is a rare and precious metal with industrial applications in automotive manufacturing, jewelry, electronics, and medical devices. Due to its dual nature—both as a store of value and an industrial commodity—platinum price movements are influenced by a mix of economic and industrial factors.

The XPTUSD symbol in forex trading is often favored by professional traders due to its volatility and sensitivity to supply-demand shifts.

🔵Trading Conditions for the Platinum Symbol in Forex

When trading platinum in forex, it’s essential to understand the specific trading conditions such as spreads, commissions, leverage, and minimum trade size.

Compared to gold and silver, platinum typically has lower liquidity, which may result in slightly wider spreads. Additionally, due to higher volatility, some brokers offer lower leverage on this symbol.

Common Trading Conditions for XPTUSD:

- Spread: Typically ranges between 3 to 7 pips (varies by broker and session)

- Commission: Often zero on standard accounts; ECN accounts may charge a small fee

- Leverage: Usually between 1:50 to 1:200 depending on broker and regulation

- Minimum Lot Size: Starts from 0.01 lots

- Market Hours: 24/5 aligned with global forex trading hours

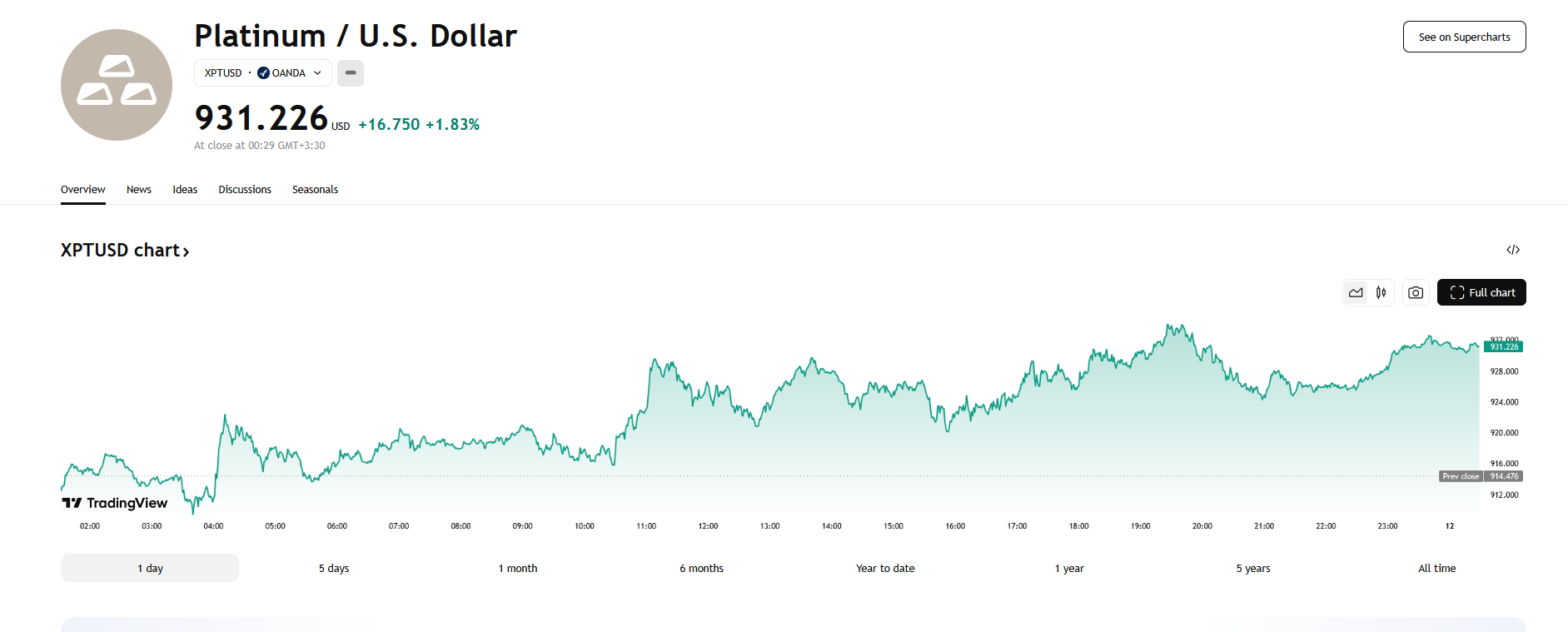

XPTUSD chart on the TradingView

🔵Best Strategies for Platinum Trading in Forex

- Breakout Strategy: Trade after price breaks through key support or resistance levels.

- Momentum Strategy: Use indicators like RSI and MACD to catch strong directional moves.

- News-Based Trading: Focus on economic news related to automotive demand or US inflation.

- Fibonacci Retracement Strategy: Identify pullback zones using Fibonacci levels to re-enter trends.

🔵Best Time to Trade the Platinum Symbol in Forex

The most favorable time to trade the platinum symbol in forex is during the London–New York session overlap, between 13:00 and 17:00 UTC. This time frame offers peak liquidity, tighter spreads, and heightened volatility driven by economic news releases—ideal conditions for short-term trading strategies.

🔵Pros and Cons of Trading Platinum in Forex

Pros:

- Great for portfolio diversification with an industrial precious metal

- Strong intraday volatility ideal for active traders

- Highly reactive to both macroeconomic and sector-specific news

- Widely available on reputable forex platforms

Cons:

- Less liquid than gold or silver

- Wider spreads on some broker accounts

- Highly sensitive to niche industrial and geopolitical developments

🔵Final Words

The Platinum symbol in Forex (XPTUSD) is a dynamic trading instrument that offers opportunities for both technical and fundamental traders.

Its unique industrial and financial characteristics make it an appealing choice for those seeking diversification beyond traditional assets. With the right strategies and risk management, platinum can be a powerful addition to any trading plan.

If you’re interested in trading Platinum the financial markets, our experts can provide you with the right guidance to access the best trading conditions.

🔵Frequently Asked Questions

What is the platinum symbol in forex?

It is XPTUSD, representing the value of one ounce of platinum in US dollars.

Is platinum a good asset to trade in forex?

Yes, it offers volatility and is influenced by both economic and industrial trends.

When is the best time to trade platinum?

During the London–New York overlap (13:00–17:00 UTC) for maximum liquidity.