Palladium symbol in forex is represented by the trading code XPDUSD, one of the valuable metals that has gained significant popularity among global traders in recent years. XPD stands for Palladium and USD represents the US dollar, together forming a trading pair that reflects the price of one ounce of palladium in USD.

Palladium is widely used in the automotive, electronics, and dental industries. Due to its high industrial demand, it experiences greater volatility compared to other precious metals. This makes it a popular choice for active traders and scalpers.

🔵Trading Conditions of the Palladium Symbol in Forex

The XPDUSD symbol is available for trading on many reputable brokers. Trading conditions may vary based on the type of account. Generally, the spread for this asset is higher than standard currency pairs, and ECN accounts may include an additional commission.

Common trading conditions for the XPDUSD symbol:

- Spread: Ranges from 15 to 50 pips (depending on broker and account type)

- Commission: May apply on ECN or Raw accounts (around $3 to $7 per lot)

- Minimum lot size: Usually starts from 0.01

- Leverage: Between 1:20 and 1:100 based on broker regulations

- Liquidity: Generally lower than gold or oil, especially outside the London session

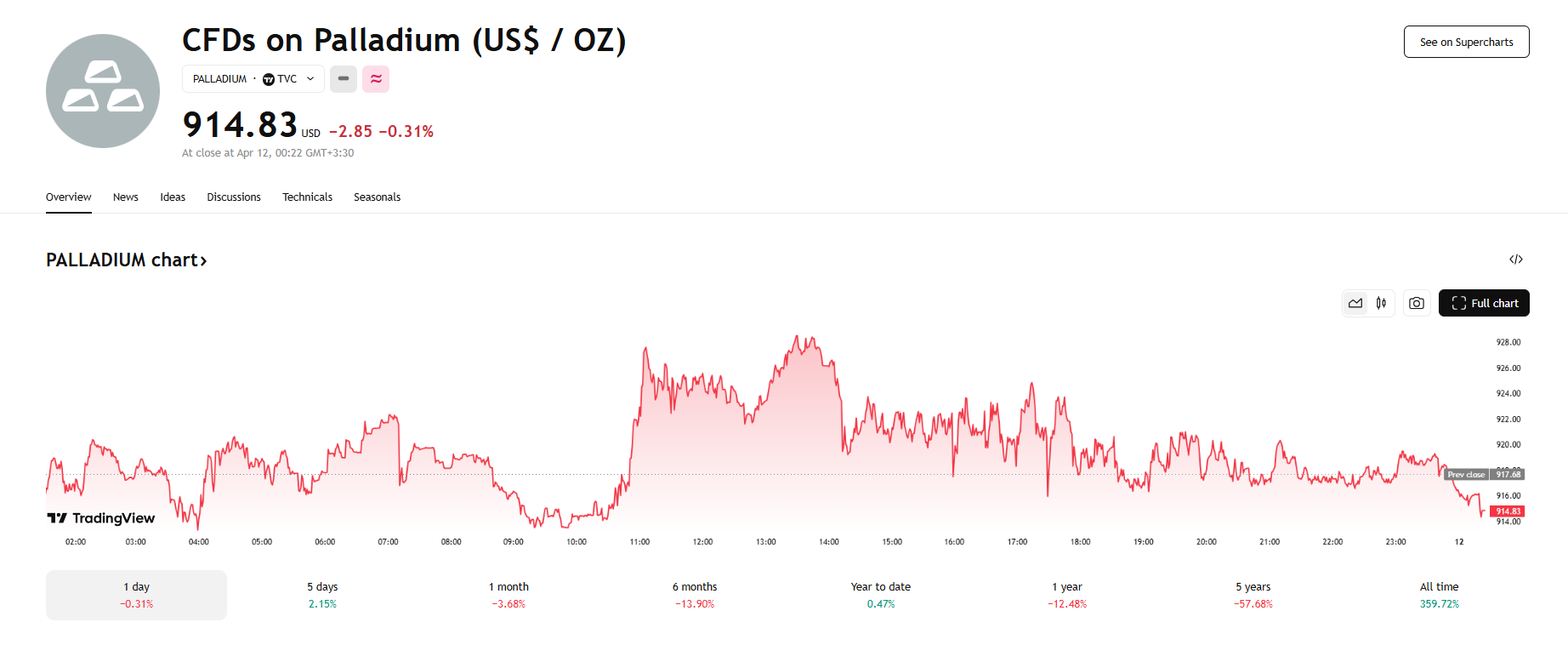

XPDUSD chart on the TradingView

🔵Best Strategies for Palladium Trading in Forex

- Price action at key support/resistance zones:

Given its high volatility, identifying key zones can provide valuable entries. - Combining RSI with divergences:

The RSI indicator along with divergence signals can help detect trend reversals. - Short-term trades during the London session:

Most trading volume for palladium occurs during this session. - Fundamental-driven trading:

Industrial reports and automotive sector data can impact price movements.

🔵Best Time to Trade the XPDUSD Symbol

The best time to trade palladium is during the London session and the early hours of the New York session. During this period, liquidity is high and spreads are usually narrower. Avoid trading during the Asian session due to lower activity and wider spreads.

🔵Pros and Cons of Palladium Trading in the Forex Market

Pros:

- High volatility offering multiple trading opportunities

- Relative correlation with automotive and industrial metals markets

- A useful asset for portfolio diversification

Cons:

- Higher spreads and trading costs

- Lower liquidity compared to gold or oil

- Highly sensitive to specific fundamental news

🔵Final Words

The Palladium symbol in forex (XPDUSD) is a unique asset suitable for traders focused on volatility and industrial trends. With a good understanding of its trading conditions, ideal timing, and smart strategies, this symbol can become a valuable part of any trading portfolio.

If you’re interested in trading Palladium in the financial markets, our experts can provide you with the right guidance to access the best trading conditions.

🔵Frequently Asked Questions

How is palladium different from gold and silver in forex?

Palladium has greater industrial demand and its price is more influenced by production and consumption factors than macroeconomic conditions.

Can I trade the XPDUSD symbol on all brokers?

No, not all brokers offer this asset. It’s recommended to choose brokers that support a wide range of metals.

What is the typical commission for palladium trades?

Standard accounts may offer commission-free trading, but ECN or Raw accounts often charge around $6 per lot.