The Nickel symbol in forex, represented by the trading code XNIUSD, indicates the value of one unit of nickel against the US dollar. This instrument is categorized as an industrial metal and has gained significant interest from global traders due to its wide use in the steel, battery, and tech industries.

XNIUSD stands for Nickel/USD and is offered by several brokers as a tradable asset. Over the past two decades, especially with the rise of electric vehicles and lithium battery production, nickel has shown notable volatility, making it an attractive option.

🔵Trading Conditions of the XNIUSD Symbol in Forex

The XNIUSD symbol is available on many reputable forex brokers, although trading conditions may vary depending on the account type and broker.

Typical trading conditions for the nickel symbol:

- Spread: Ranges from 20 to 60 pips (depending on broker and account type)

- Commission: Around $5 to $7 per lot on ECN or Raw accounts

- Minimum trade size: Starts from 0.01 lots

- Leverage: Typically between 1:20 and 1:100

- Liquidity: Moderate, with higher volume during the European session

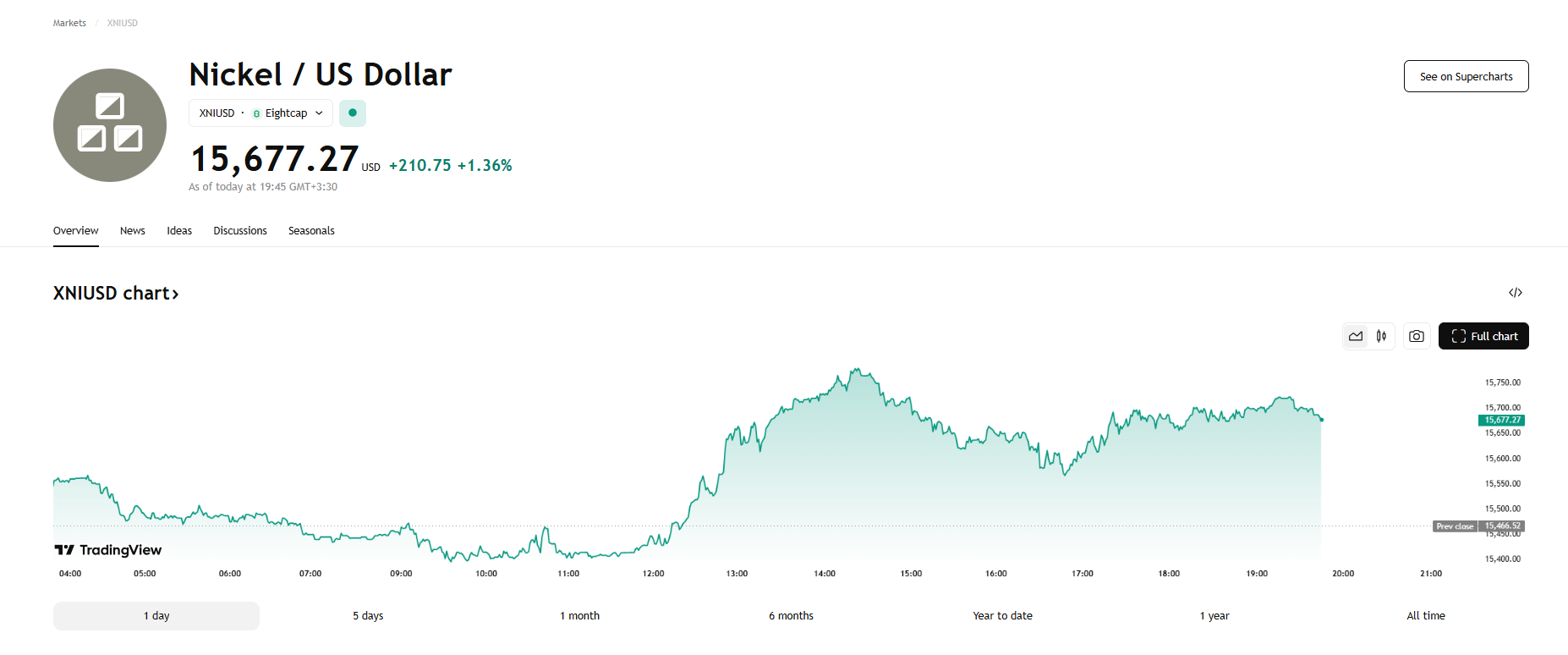

XNIUSD chart on the TradingView

🔵Best Strategies for Nickel Trading in Forex

- Price action at key levels: Use support and resistance zones for optimized entry points

- Combining RSI and MACD: Detect divergence and overbought/oversold signals

- Fundamental analysis: News on production, exports, and the auto sector can significantly impact prices

- Pullback trading: Enter after retracements in strong up/down trends

- Channel-based trading: Nickel often trends within ascending or descending channels

🔵Best Time to Trade the XNIUSD Symbol

The best time to trade nickel in forex is during the London session and early hours of the New York session. These periods offer the highest liquidity and tighter spreads.

Avoid trading during the Asian session, especially before European markets open, as low volume and wider spreads can reduce efficiency.

🔵Pros and Cons of Trading Nickel in Forex

Pros:

- Multiple trading opportunities due to high volatility

- Reacts directly to industrial news and global demand

- Great for diversifying commodity portfolios

Cons:

- Higher trading costs compared to forex pairs

- Lower liquidity outside the European session

- Highly sensitive to geopolitical and industrial developments

🔵Final Words

The XNIUSD symbol offers a unique opportunity for traders focused on industrial market trends and price volatility. By understanding its trading conditions, ideal timing, and effective strategies, nickel can be a valuable addition to any trading portfolio.

If you’re interested in trading Nickel in the financial markets, our experts can provide you with the right guidance to access the best trading conditions.

🔵Frequently Asked Questions

How does nickel differ from gold or silver in trading?

Unlike gold, nickel has high industrial usage and is driven mainly by supply-demand fundamentals.

Do all brokers offer the XNIUSD symbol?

No. Only select brokers offer nickel among their list of metals and commodities.

What is the typical commission when trading nickel?

Usually around $5–$7 per lot on ECN accounts, depending on the broker.