The natural gas symbol in forex is known as NGAS and represents the price of natural gas against the US dollar. This asset falls under the energy commodities category and is popular among traders in the global commodities market.

The NGAS or Natural Gas/USD symbol typically appears as NGAS or XNGUSD on trading platforms. Due to the widespread use of natural gas in industry, power generation, and residential consumption, this asset is affected by various factors including supply, demand, weather conditions, and geopolitical developments.

Over the past decade, NGAS has shown high volatility, especially during energy market disruptions, making it an appealing instrument for active traders.

🔵Trading Conditions for the Natural Gas Symbol in Forex

When trading the NGAS symbol in forex, it’s important to understand its specific trading conditions. Given its volatility and peak liquidity at certain times, brokers may offer different setups for this asset:

- Spread: Typically between 3 to 6 pips (varies by broker and account type)

- Commission: $5–$7 per lot on ECN accounts

- Leverage: Usually ranges from 1:50 to 1:200

- Minimum trade size: Starts from 0.01 lots

- Liquidity: High during the U.S. trading session

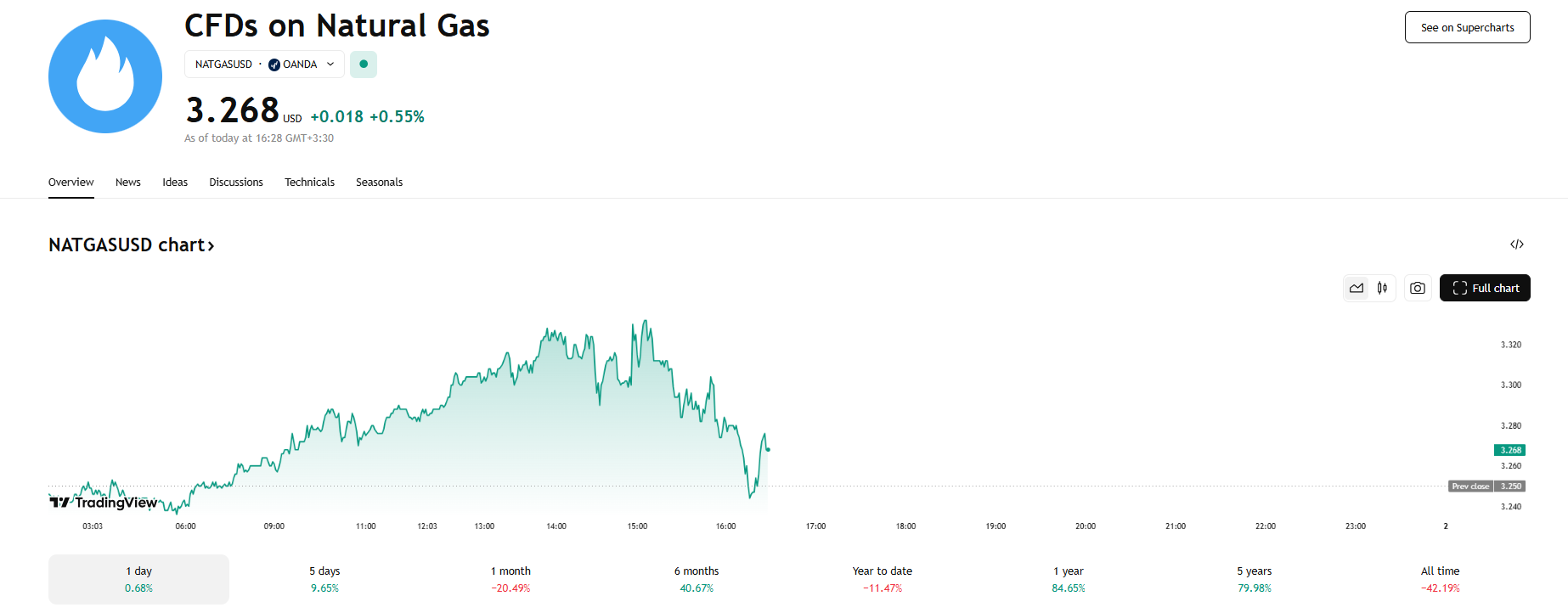

Live NGAS price chart on TradingView

🔵Best Strategies for NGAS Trading in Forex

- Breakout Strategy: Entering trades when price breaks major resistance or support levels.

- Using MACD & RSI: Identifying divergence and ideal entry/exit points.

- News-Based Trading: Reacting to U.S. natural gas inventory reports and weather forecasts.

- Channel Trading: Using rising or falling channels to spot reversal points.

- Commodity Hedging: Adding NGAS to hedge energy exposure in your trading portfolio.

🔵Best Time to Trade the Natural Gas in Financial Markets

The most effective time to trade NGAS in forex is during the New York trading session, from 13:00 to 21:00 GMT. This period features the highest trading volumes, lower spreads, and crucial energy-related news releases, creating optimal conditions for active traders.

🔵Pros and Cons of Trading Natural Gas in Forex

Pros:

- High volatility creates frequent trading opportunities

- Fast reaction to energy news and climate data

- Widely available across major Forex brokers

Cons:

- Highly sensitive to news events, increasing risk of slippage

- Requires a mix of technical and fundamental analysis

- Liquidity may drop during off-peak hours

🔵Final Words

The Natural Gas symbol in Forex (NGAS) presents a dynamic opportunity for traders seeking high-volatility assets. With the right understanding of trading conditions, market timing, and proven strategies, NGAS can serve as a powerful addition to a professional trading portfolio.

If you’re interested in trading Natural Gas in the financial markets, our experts can provide you with the right guidance to access the best trading conditions.

🔵Frequently Asked Questions

What does the NGAS symbol mean?

It reflects the value of natural gas in US dollars in the Forex market.

Is natural gas trading considered risky?

Yes, due to its high volatility, proper risk management is essential.

When is the best time to trade natural gas in financial markets?

During the New York session, especially around major energy news releases.