Regardless of the profits and losses made by traders, Forex brokers are looking for ways to earn money to run and maintain their businesses. Unfortunately, not all brokers are clear about this. Some brokers may apply hidden fees to get more money from their clients. This is why it is so important for traders to know how this process is done.

In the following, we will examine the different methods that brokers use to earn money and help you choose between commission and spread.

How do brokerage companies make money?

Different brokers use different pricing methods to make money. Generally, Forex brokers make money from two conventional methods. First, they receive spreads and commissions from their clients and make a profit. Another way is to create a market and earn money from traders’ losses.

How the spread works?

Spread is the difference between the bid and ask price of a particular asset. The bid price is the price that the broker gives to the trader for the currency, while the asking price is the price that the broker gives to the trader to sell the currency. If you look at your trading platform, you will notice that there is always a difference between the buying and selling price of the asset. This difference is what we call the spread.

In other words, Forex brokers show the Ask and Bid rates for all currency pairs. These two prices form the Forex structure.

Ask: the asking price of the broker or exchange to sell currency to the trader

Bid: the suggested price of a broker or exchange to buy currency from a trader

For every trade, you only have to pay the spread once. The actual amount of the spread may vary depending on the asset you are trading. Major currency pairs that are traded more usually have lower spreads, while minor currency pairs have higher spreads. Also, note that spreads can increase during important news announcements and extreme market volatility.

Types of spreads in the Forex market

Usually two types of spreads are found in brokers who are active in Forex market, each of which has different characteristics.

Fixed spread

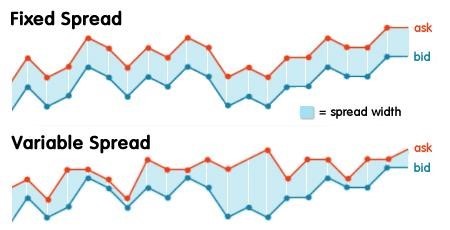

A fixed spread is a type of spread that remains fixed regardless of market conditions. In other words, whether the market is highly volatile or somewhat calm, the fixed spread will not be affected. This type is usually offered by market makers or the “dealing desk” model. This type of spread also indicates a market maker trading account.

The advantage of using fixed spreads is that they usually require less capital, so it is a cheaper alternative for traders who don’t have a lot of money in their pocket for trading. It can also give you a feeling of assurance; Because its’ value rarely changes, so you can calculate trading costs even before opening a position.

Variable or floating spread

As its name suggests, variable spread is a type of spread that is constantly changing. This means that the spread will increase or decrease based on currency supply and demand and general market fluctuations. This type is usually more suitable for long-term traders; Because their trades have a more limited schedule. Floating spreads usually decrease during quiet market times and increase when volatility is high or liquidity is low. In the floating spread, the ask-to-bid difference at the time of opening a trade is different from the ask to bid difference at the time of closing that trade.

How the commission works?

The commission is a type of trading fee in Forex that is paid by traders to brokers, which is determined according to the volume of transactions you choose, that you have to pay to the broker.

Some brokers may charge clients a fixed amount of commission per trade. This option is considered useful for traders who like to trade during news releases or with low liquidity. This system can protect traders from abnormally wide spreads in special market conditions and minimize the chances of price retries and slippages.

Many traders are attracted to this offer and think that they can reduce their trading costs by not paying the spread. Brokers with this type of account usually charge a commission and require a high minimum account size, so it might not be suitable for all types of traders in the market.

Which one is better?

The question of which option is better between spread and commission depends on the needs of the trader. Some traders may find spreads more profitable; Because they don’t trade often and some others may decide to pay commission for a completely different reason.

Therefore, whether the spread is better or the commission depends entirely on the traders and they must first determine whether they want to pay the spread or the commission. Then, according to their desire and the type of their transaction, they can choose the trading account that is suitable for them.

If you just choose the spread, you don’t need to pay commission anymore. On the other hand, if you choose commission, you will have to pay a fixed commission for each transaction. It is also very important to know what kind of broker you are dealing with in order to be able to choose the best method.