The Cocoa symbol in forex is one of the attractive soft commodities available for traders. Represented as “COCOA” on trading platforms, it reflects the price of cocoa in US dollars in international markets.

Cocoa has a long-standing history in global trade, with major production concentrated in African countries like Ivory Coast and Ghana. Its price is highly sensitive to weather conditions and supply-demand dynamics, making the cocoa symbol a popular tool for both risk hedging and profit opportunities.

🔵Trading Conditions for the COCOA Symbol in Forex

When trading the Cocoa symbol, it is important to consider factors such as spread, commission, leverage, and minimum trade size.

Due to relatively lower liquidity compared to major forex pairs, cocoa spreads may be slightly wider. Additionally, seasonal volatility leads brokers to offer more conservative leverage options for this commodity.

🔹 Common trading conditions for Cocoa:

- Spread: Typically ranges between 3 to 6 pips (depending on broker and trading hours)

- Commission: Generally commission-free in standard accounts; may apply in ECN accounts

- Leverage: Usually between 1:10 and 1:20

- Minimum trade size: From 0.01 lots

- Trading hours: Primarily active during New York session hours, aligned with ICE Exchange operations

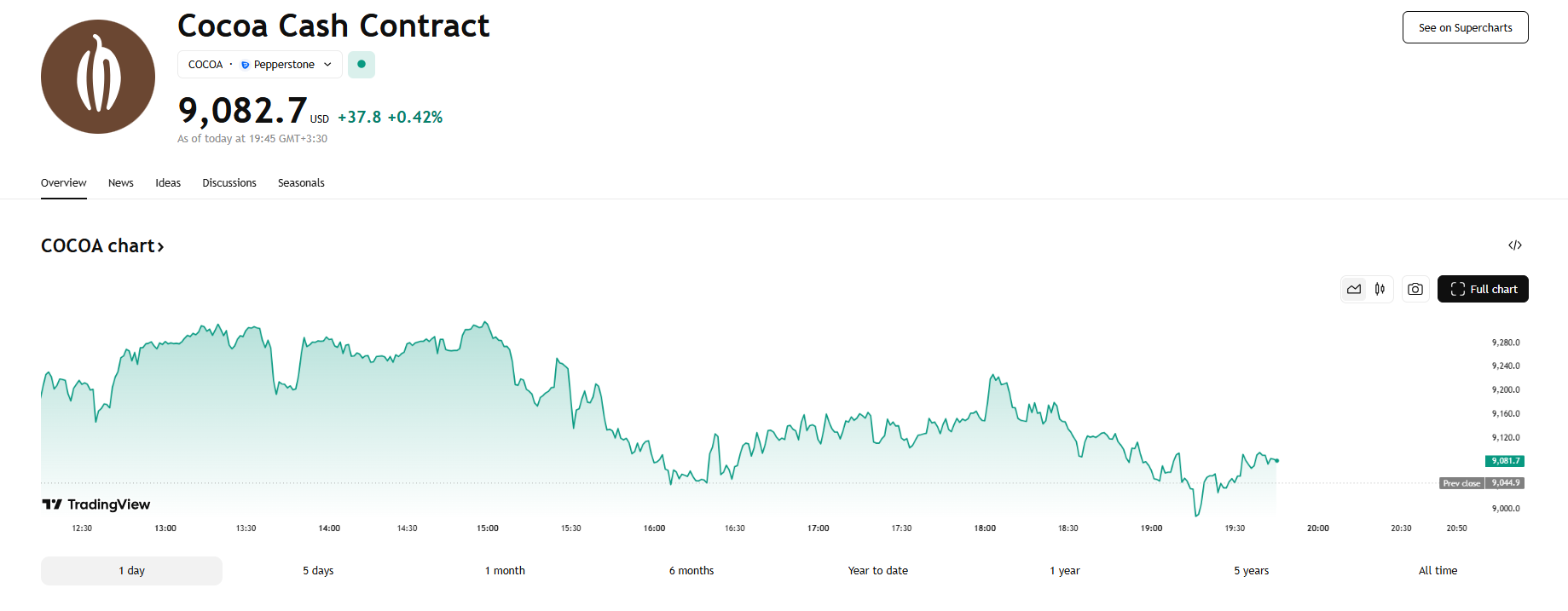

Cocoa symbol price chart on TradingView

🔵Best Strategies for Trading the COCOA Symbol in Financial Markets

- Harvest Season Trading Strategy: Capitalizing on price movements during cocoa harvest periods.

- Price Action Strategy: Analyzing price behavior around key support and resistance levels.

- Fundamental Analysis Approach: Monitoring supply-demand reports and weather changes in production regions.

- Trend Following Strategy: Identifying long-term trends using weekly or monthly charts.

🔵Best Time to Trade the COCOA Symbol

The best time for cocoa trading in forex is typically during the New York session, when trading activity on the ICE (Intercontinental Exchange) is at its peak. This window spans approximately from 13:30 to 20:00 GMT.

🔵Pros and Cons of Trading the COCOA Symbol

Advantages:

- Potential for high-profit opportunities due to strong price volatility

- Effective tool for hedging against commodity price fluctuations

- Helps diversify trading portfolios

Disadvantages:

- High volatility and weather-related trading risks

- Susceptibility to geopolitical instability in cocoa-producing countries

- Lower liquidity compared to major forex instruments

🔵Final Words

Trading the Cocoa symbol in forex offers a unique opportunity to diversify portfolios and capitalize on the volatility of soft commodities. With a proper understanding of market conditions, effective strategies, and sound risk management, traders can make the most of the opportunities presented by cocoa trading.

If you’re interested in trading Cocoa in the financial markets, our experts can provide you with the right guidance to access the best trading conditions.

🔵FAQs

What is the Cocoa symbol in forex?

It is represented by the code COCOA or CC, indicating the price of cocoa against the US dollar.

Which brokers are best for cocoa trading in forex?

Brokers like IG, Pepperstone, and AvaTrade that offer CFD trading on commodities are suitable for trading cocoa.

Is trading cocoa in forex risky?

Yes, due to its price sensitivity to weather and geopolitical factors, cocoa trading carries higher risks compared to major forex pairs.