Bitcoin (BTC) is the world’s first decentralized cryptocurrency, introduced in 2009 by an unknown individual or group using the pseudonym Satoshi Nakamoto. Built on blockchain technology, Bitcoin was designed to eliminate financial intermediaries like banks and enable direct peer-to-peer transactions globally.

🔵A Brief History of Bitcoin

- 2008: Release of the Bitcoin whitepaper by Satoshi Nakamoto titled “Bitcoin: A Peer-to-Peer Electronic Cash System”

- 2009: The first block (Genesis Block) is mined

- 2010: The first real-world transaction: two pizzas purchased for 10,000 BTC

- Since 2011: Gradual adoption and launch of major crypto exchanges

🔵Technical Features of Bitcoin

- Consensus Algorithm: Bitcoin uses Proof of Work (PoW), where miners solve complex mathematical problems to add new blocks to the blockchain. This process requires significant computing power and energy.

- Limited Supply: Only 21 million bitcoins can ever be mined. This built-in scarcity gives Bitcoin anti-inflationary properties, unlike fiat currencies that can be printed without limit.

- Block Time: A new block is added approximately every 10 minutes, ensuring predictable issuance and contributing to the network’s stability.

- Halving Events: Miner rewards are halved approximately every four years in a process known as “halving,” which regulates supply and impacts market dynamics.

- Decentralized and Open Source: Bitcoin is not controlled by a central authority. Its codebase and transaction history are public and transparent, boosting trust in the network.

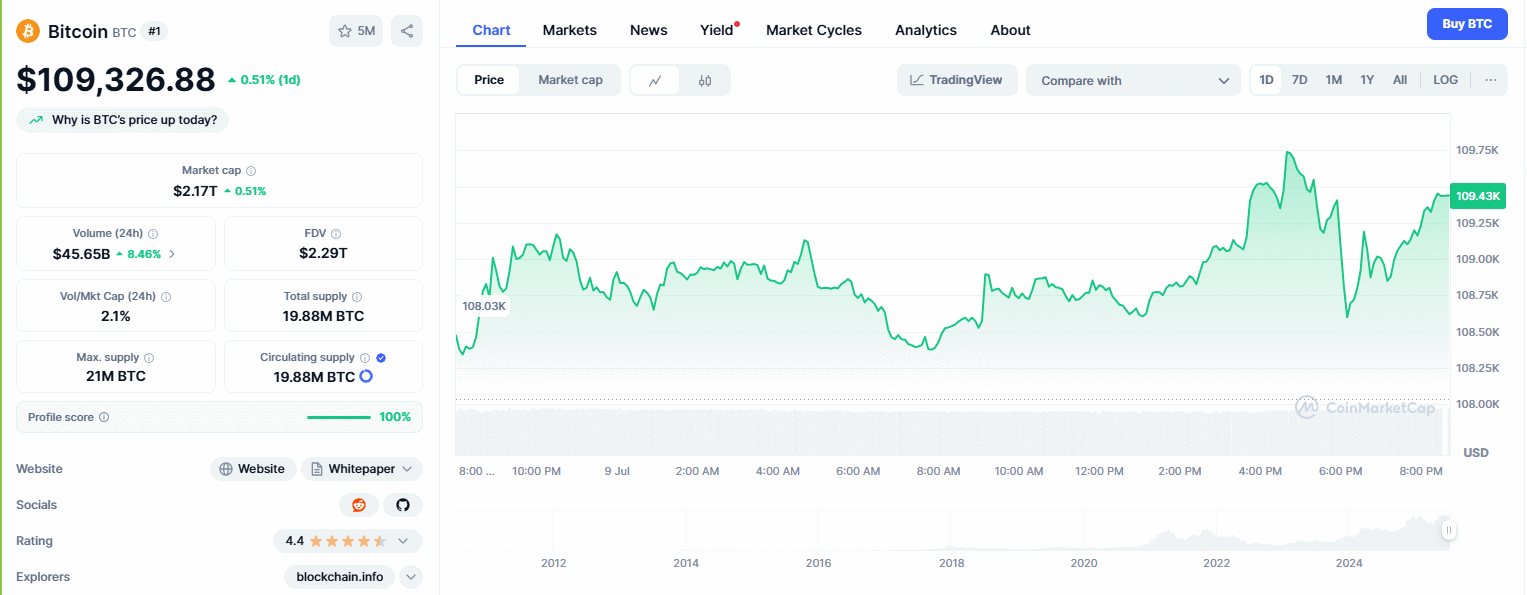

🔵Bitcoin Price Overview

When Bitcoin was first introduced in 2009, it had virtually no market value and traded for less than a cent. Over time, as adoption grew, its price surged dramatically. The highest officially recorded price for Bitcoin was around $69,000 in November 2021.

By 2025, some exchanges have recorded prices exceeding $100,000, making Bitcoin one of the best-performing assets in modern financial history.

Real-time Bitcoin price chart on CoinMarketCap

🔵Use Cases of Bitcoin

As a decentralized currency, Bitcoin offers diverse real-world use cases. One of its primary uses is international money transfers without the need for banks or other intermediaries, offering lower fees and faster settlements.

Many people also view Bitcoin as a store of value, similar to gold. Its limited supply and resistance to inflation make it appealing for long-term preservation of wealth.

In certain countries and businesses, Bitcoin is accepted as a method of payment. Online stores, restaurants, and service providers increasingly offer BTC as a payment option.

Finally, Bitcoin is a central asset in crypto trading and investment. Thousands of traders worldwide actively buy and sell Bitcoin to profit from its price volatility.

🔵Advantages of Bitcoin

- High security through strong cryptography

- Censorship-resistant transactions

- Fixed supply to prevent systemic inflation

- Full transparency via the public blockchain

🔵Disadvantages of Bitcoin

- Slower transaction speed compared to newer blockchains

- High transaction fees during network congestion

- Significant energy consumption due to mining

- High price volatility

🔵Bitcoin: Buying the Asset vs. Trading Derivatives

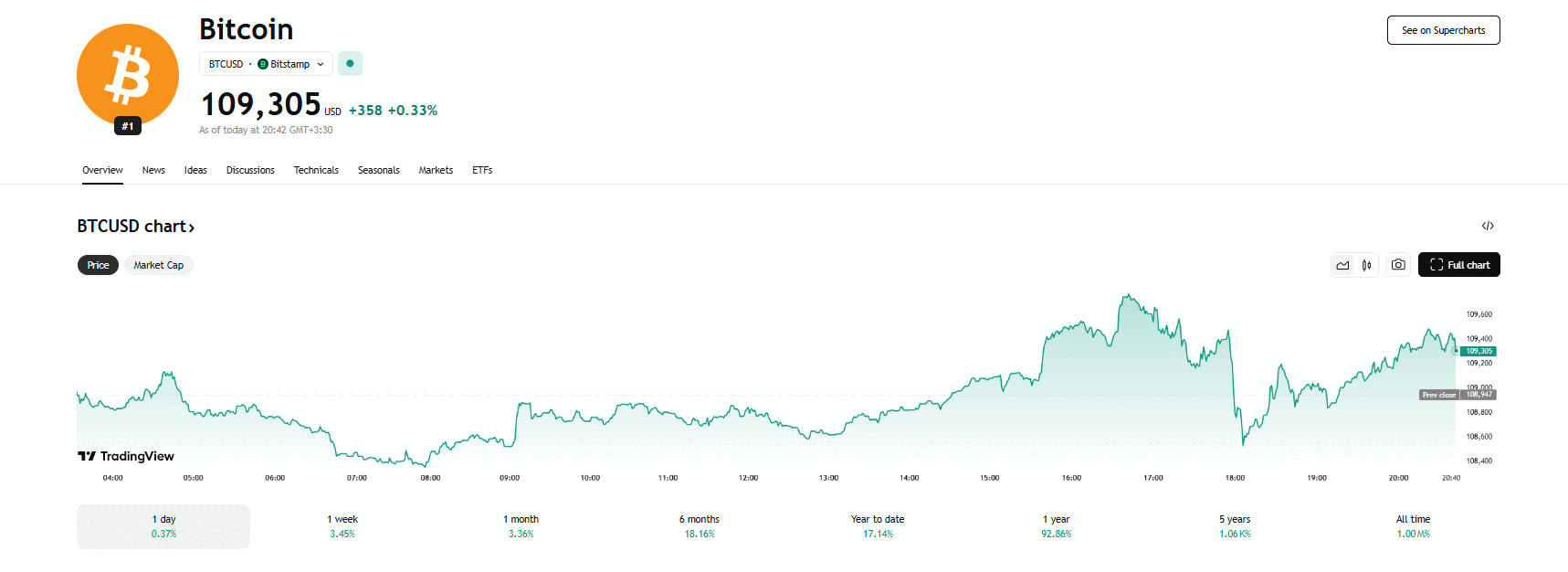

There are two main ways to gain exposure to Bitcoin: spot purchases and trading derivatives like CFDs or Forex contracts.

In a spot purchase, you own actual BTC. You can store it in a digital wallet, transfer it, or use it for payments. This approach suits those with a long-term outlook who want to hold a real crypto asset.

real-time Bitcoin/USD chart on TradingView

On the other hand, derivatives trading involves speculating on Bitcoin’s price movements without owning the underlying asset. This is common in platforms like Forex or CFD brokers and is typically used by short-term traders seeking to profit from volatility.

Each method has its pros and cons, and the right choice depends on your investment goals, risk tolerance, and technical knowledge.

🔵Conclusion

Since its inception in 2009, Bitcoin (BTC) has grown from a virtually worthless digital token to an asset valued at over $100,000. Its 21 million coin cap, proof-of-work consensus mechanism, and peer-to-peer nature have set the foundation for the entire cryptocurrency industry.

Bitcoin continues to play a pivotal role as a store of value, a tool for global transfers, and a gateway to decentralized finance. Despite regulatory challenges and scalability concerns, growing institutional interest and mainstream adoption have solidified its position as the leading digital asset.

If you’re interested in BTC, our experts can provide you with the right guidance to access the best trading conditions.

🔵Frequently Asked Questions (FAQ)

Is Bitcoin traceable?

Yes. All Bitcoin transactions are publicly recorded on the blockchain, although the identities behind wallet addresses are not directly linked.

Is Bitcoin legal?

It depends on the country. In Iran, for example, holding Bitcoin is not a crime for individuals, but commercial use may require a license.

Is Bitcoin a good investment?

Bitcoin carries a high degree of risk but is often viewed as a long-term store of value by many investors.