The S&P symbol in forex is one of the most widely used Forex symbols for market analysis and trading. Known globally as the S&P 500, it is commonly represented on trading platforms under codes like US500, SPX500, or SP500.

Launched in 1957 by Standard & Poor’s, the S&P 500 consists of 500 leading U.S. companies across diverse industries. It serves as a strong indicator of the overall health of the U.S. economy, with more weight assigned to companies with larger market capitalizations. This makes it a preferred benchmark for assessing broader market trends.

🔵Trading Conditions for the S&P Symbol in Forex

The S&P500 trading in forex is typically done via CFDs, with trading conditions varying slightly across brokers. Standard trading conditions include:

- Spread: Typically ranges from 0.3 to 1.5 pips in standard accounts

- Commission: $3 to $7 per lot in raw spread or ECN accounts

- Minimum Trade Size: 0.01 lots

- Leverage: Ranges from 1:50 to 1:200, depending on broker policies and account type

- Liquidity: Extremely high during the New York session

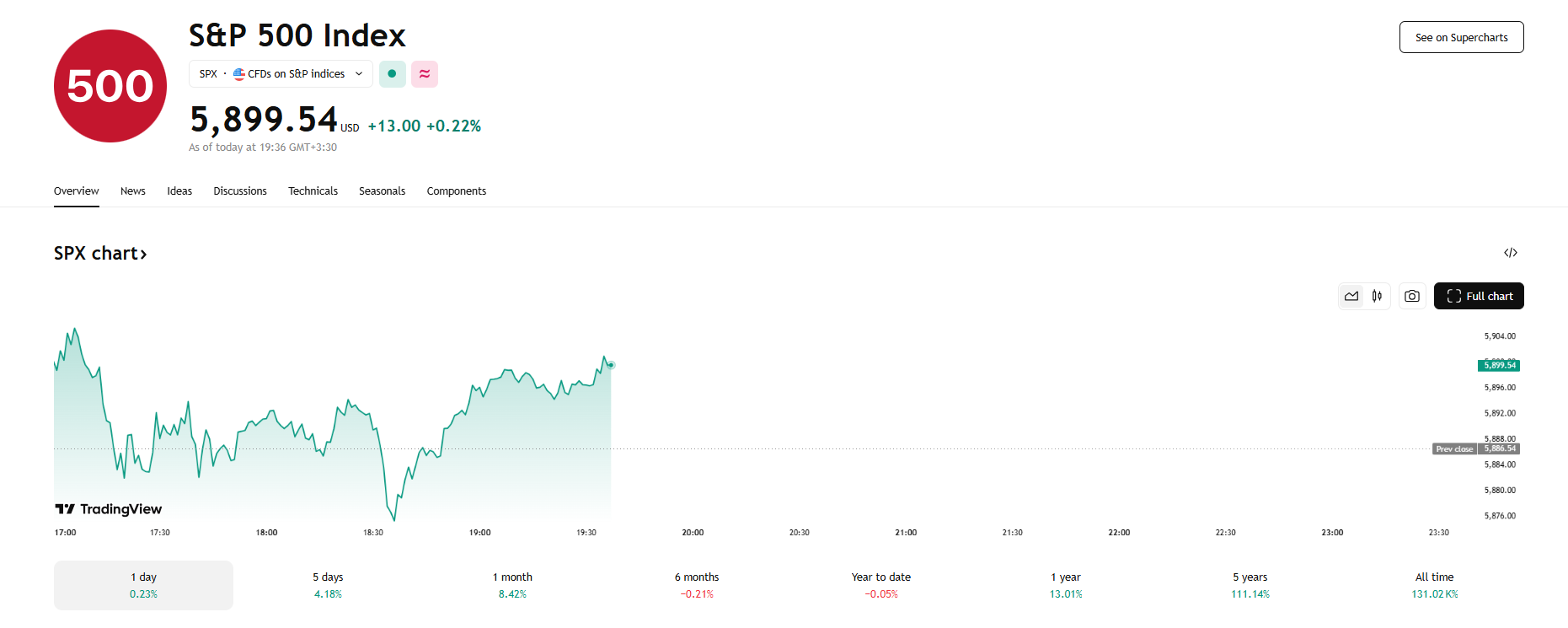

Live S&P 500 Chart: S&P 500 Chart on TradingView

🔵Best Strategies for Trading the S&P Symbol in Financial Markets

- Trend-Following Strategy: Use 50 and 200 Moving Averages to identify and follow the main trend.

- Economic News Trading: Enter trades during key U.S. data releases like Fed rate decisions or NFP reports.

- Pullback Strategy: Enter trades after a corrective move in the direction of the primary trend.

- Scalping During NY Open: Leverage the high volatility in the early hours of the New York session for short-term gains.

🔵Best Time to Trade the S&P Symbol

The best time to trade the S&P500 symbol is during the New York session, particularly from 13:30 to 20:00 GMT. This is when the New York Stock Exchange is active and trading volumes peak, creating ideal conditions for intraday traders.

🔵Pros and Cons of Trading the US500 in Forex

Pros:

- Consistent and predictable volatility

- Exposure to a diversified range of U.S. industries

- Suitable for both short-term and long-term strategies

- High liquidity during active market hours

Cons:

- Highly influenced by U.S. economic data and news

- Requires combined technical and fundamental analysis

- Price gaps during market open can add risk

🔵Final Words

The S&P symbol in forex offers diverse trading opportunities and serves as a key benchmark for the U.S. market. With the right strategy, timing, and understanding of its trading structure, traders can effectively benefit from movements in the S&P 500 index.

If you’re interested in trading SPX500 in the financial markets, our experts can provide you with the right guidance to access the best trading conditions.

FAQs

What is the S&P500 symbol in forex?

It represents the performance of 500 large U.S. companies and appears under codes like US500 or SPX500 on trading platforms.

Is US500 index available on all brokers?

No, only brokers that offer index CFDs provide access to this instrument.

When is the best time to trade the S&P 500 in financial markets?

The New York session (13:30 to 20:00 GMT) offers the best trading conditions for this index.