The DAX symbol in forex is one of the most prominent European indices among Forex symbols actively traded by analysts and investors in international markets. Known in English as DAX, it is commonly displayed as GER40 or DE30 on trading platforms and represents the performance of the top 40 companies listed on the Frankfurt Stock Exchange in Germany.

Launched in the 1980s, the DAX index has become a benchmark for the economic health of Germany, the largest economy in Europe. It includes companies across various industries such as automotive, chemicals, technology, and finance. With high liquidity, strong price movement, and responsiveness to Eurozone news, this index is a popular choice for professional traders.

🔵Trading Conditions for the DAX Symbol in Forex

Trading the DAX symbol is typically carried out through CFDs, and conditions may vary by broker.

Standard trading conditions for the GER40 symbol in forex include:

- Spread: Typically ranges from 0.8 to 2.5 points, depending on market hours and account type

- Commission: Zero in most standard accounts; $3 to $7 per lot in ECN accounts

- Minimum Trade Size: 0.01 lots

- Leverage: From 1:50 to 1:200 depending on broker policies and regulations

- Liquidity: High during both the European and New York trading sessions

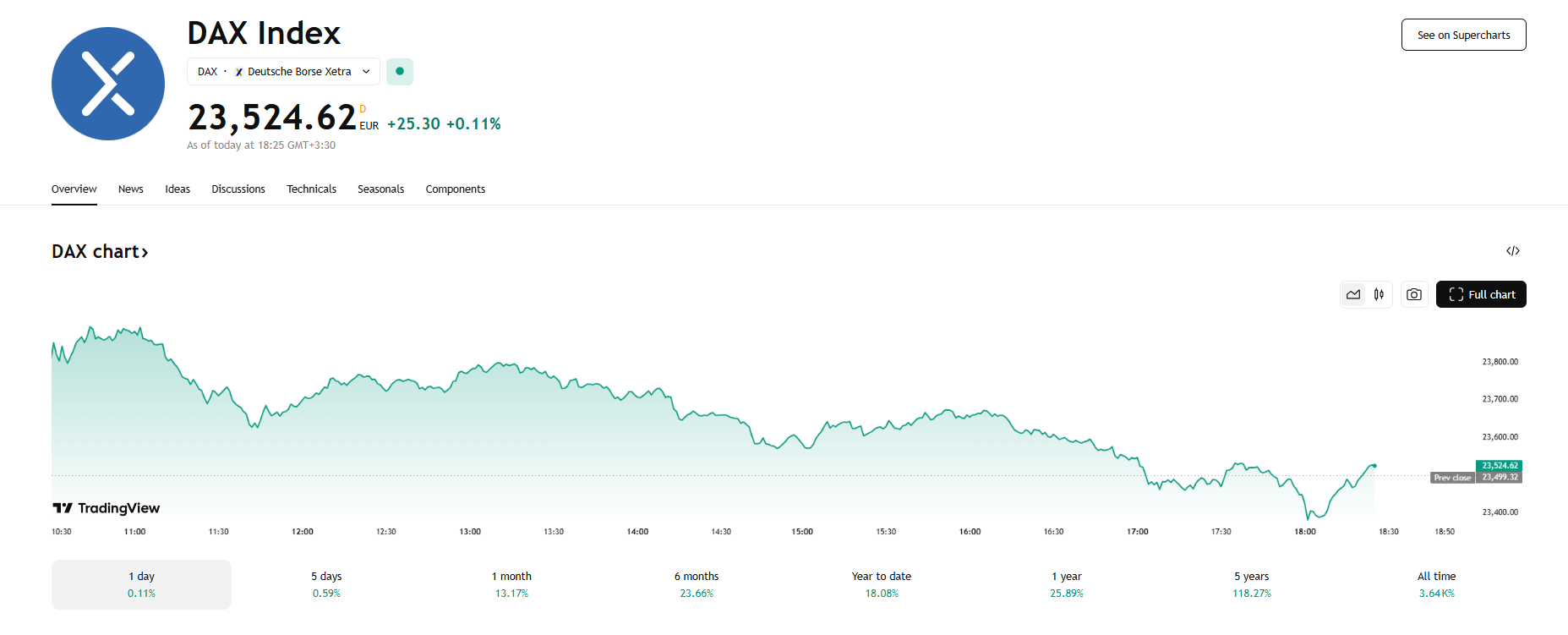

Live DAX Chart: DAX Chart on TradingView

🔵Best Strategies for Trading the GER40 Symbol in Forex

- Moving Average Crossover Strategy: Use EMA-50 and EMA-200 to identify trend direction and trade in alignment with momentum.

- News-Based Trading on Eurozone Economic Releases: Capitalize on announcements such as ECB rate decisions or PMI data.

- Channel Trading Strategy: Trade within support and resistance zones using dynamic price channels.

- Frankfurt Open Breakout Strategy: Utilize high volume during early market hours for breakout entries.

🔵Best Time to Trade the DAX-40 Symbol in Financial Markets

The optimal time to trade the GER40 symbol is during the early hours of the European session (08:00 to 11:00 GMT). During this period, the Frankfurt Exchange is active, and trading volume is elevated. The overlap with the New York session (12:00 to 16:00 GMT) also provides additional volatility and opportunity.

🔵Pros and Cons of Trading the DAX Symbol

Pros:

- High liquidity during European market hours

- Quick reaction to economic data releases

- Ideal for day trading and scalping

- Available on most major forex brokers

Cons:

- Sharp volatility during major news releases may cause slippage

- Highly dependent on Eurozone economic trends

- Requires both technical and fundamental analysis skills

🔵Final Words

The DAX symbol in forex is a powerful choice for traders seeking exposure to major stock indices. With the right understanding of trading conditions, timing, and strategy, traders can take advantage of the dynamic movements of this leading German index.

If you’re interested in trading GER40 in the financial markets, our experts can provide you with the right guidance to access the best trading conditions.

🔵FAQs

What is the DAX symbol in forex?

It reflects the performance of Germany’s top 40 companies and is usually represented as GER40 on trading platforms.

Is the GER40 available with all brokers?

No, only brokers that offer index CFDs will list the GER40 for trading.

When is the best time to trade the DAX index?

The early European session (08:00 to 11:00 GMT) and the overlap with the New York session offer the best trading opportunities.