The “Sugar symbol in forex” is one of the popular assets for commodity traders in global markets. In English, it is represented as “Sugar” and is commonly seen on trading platforms with symbols like “SUGAR#” or “SUGARc1”. Sugar trading in forex attracts many traders due to its seasonal price volatility and its sensitivity to weather conditions.

Sugar, with a long-standing history in global trade, plays a vital role in the international economy. Major producers include countries such as Brazil, India, and Thailand. Key features of this commodity include significant sensitivity to climatic changes, agricultural policies, and global demand for food products.

🔵Trading Conditions for Sugar Symbol in Forex

Trading sugar in forex comes with specific conditions that traders must consider:

- Spread: Typically ranges between 3 to 5 pips, depending on the broker.

- Commission: Usually commission-free on standard accounts; separate charges may apply on ECN accounts.

- Minimum lot size: Tradable from 0.01 lots.

- Leverage: Ranges from 1:10 to 1:100, based on the broker.

- Trading hours: Generally available 24/5, from Monday to Friday, except during commodity market closures.

Note that these features may vary across brokers, so it’s essential to check your broker’s exact trading conditions before starting.

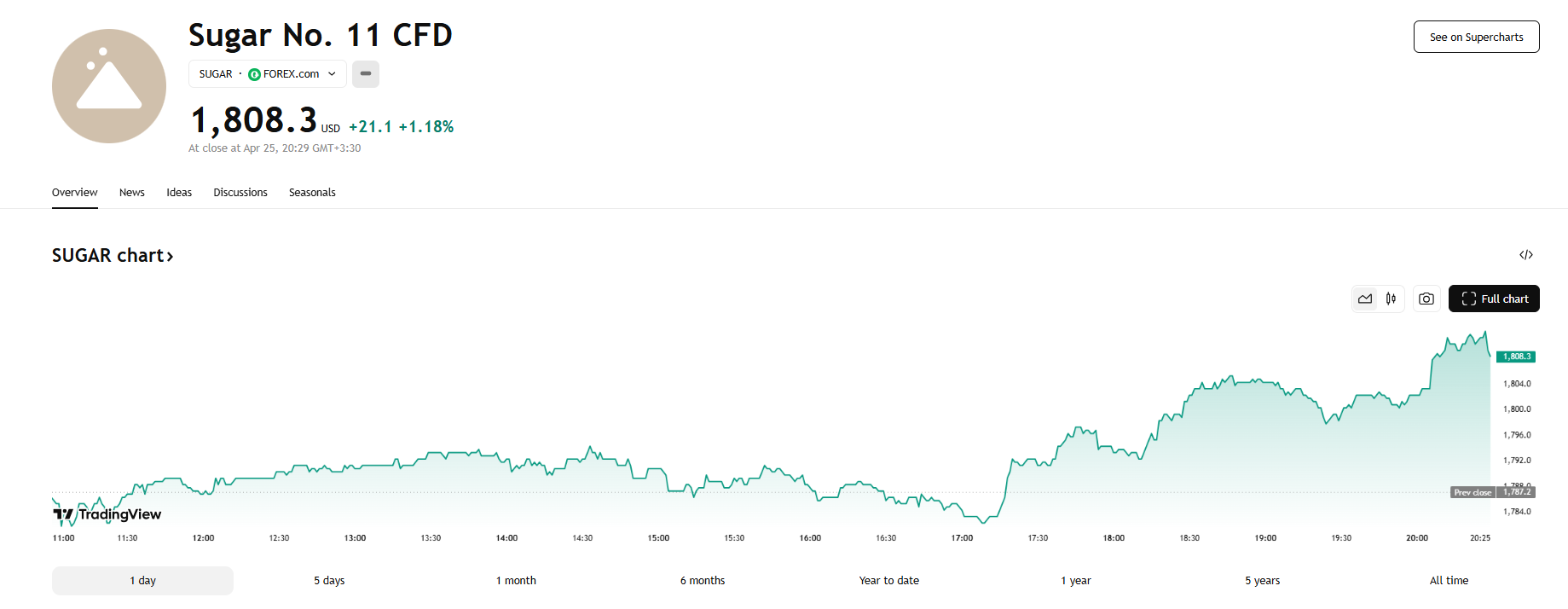

View Sugar price chart on TradingView

🔵Best Strategies for Trading Sugar Symbol in Forex

- Seasonal Trend Analysis: Reviewing sugar’s price behavior during specific months like harvest periods.

- Trend Following Strategy: Using indicators like moving averages to identify strong market trends.

- News Trading Strategy: Reacting promptly to news about major producers, such as weather reports from Brazil.

- Support and Resistance Strategy: Identifying key price levels for accurate entries and exits.

🔵Best Time to Trade Sugar Symbol in Financial Markets

The best time for trading the sugar symbol is typically during the New York session. This session overlaps with the US commodity markets, resulting in higher liquidity and more trading opportunities for traders.

🔵Pros and Cons of Trading Sugar in Forex

Advantages:

- Favorable volatility for short- and long-term trading opportunities.

- Predictable seasonal patterns aiding trend anticipation.

- Ability to trade with leverage and lower initial investment.

Disadvantages:

- High sensitivity to unpredictable events like natural disasters.

- Requires constant monitoring of global agricultural news.

- Potential for sudden price spikes during major news events.

🔵Final Words

Trading the sugar symbol in financial markets can offer excellent opportunities for professional traders due to its unique price behavior and global influences. By understanding trading conditions, choosing the right time to trade, and applying suitable strategies, traders can better capitalize on this commodity.

If you’re interested in trading SUGAR in the financial markets, our experts can provide you with the right guidance to access the best trading conditions.

🔵Frequently Asked Questions

What is the Sugar trading symbol in forex?

The Sugar symbol, represented as SUGAR# or SUGARc1, indicates trading sugar against the US dollar in forex markets.

Does trading sugar in forex involve commission?

Typically, it’s commission-free on standard accounts but may involve a fee on ECN accounts.

What is the best time to trade the Sugar symbol?

The New York session is considered the best time for trading sugar.