The COFFEE symbol in forex refers to the global price of coffee quoted in US dollars and is represented by the symbol COFFEE across most trading platforms. Traders can access this commodity via CFDs (Contracts for Difference) or futures and speculate on its price fluctuations in the global market.

Coffee is one of the most widely consumed agricultural commodities worldwide and is highly sensitive to weather conditions, geopolitical events, and economic data. As Brazil, Vietnam, and Colombia are major exporters, any disruption in their output can significantly impact global COFFEE prices, making it a highly reactive and potentially profitable asset for active traders.

🔵Trading Conditions for the COFFEE Symbol

COFFEE trading in forex involves specific trading conditions that vary by broker and account type. However, most reputable brokers offer the following general parameters:

- Spread: Typically ranges from 40 to 80 pips

- Commission: Around $3 to $7 per lot in ECN accounts

- Minimum Trade Size: Commonly 0.1 lots

- Leverage: Usually between 1:20 and 1:50 for agricultural commodities

- Liquidity: High during the U.S. trading session, especially during the New York open

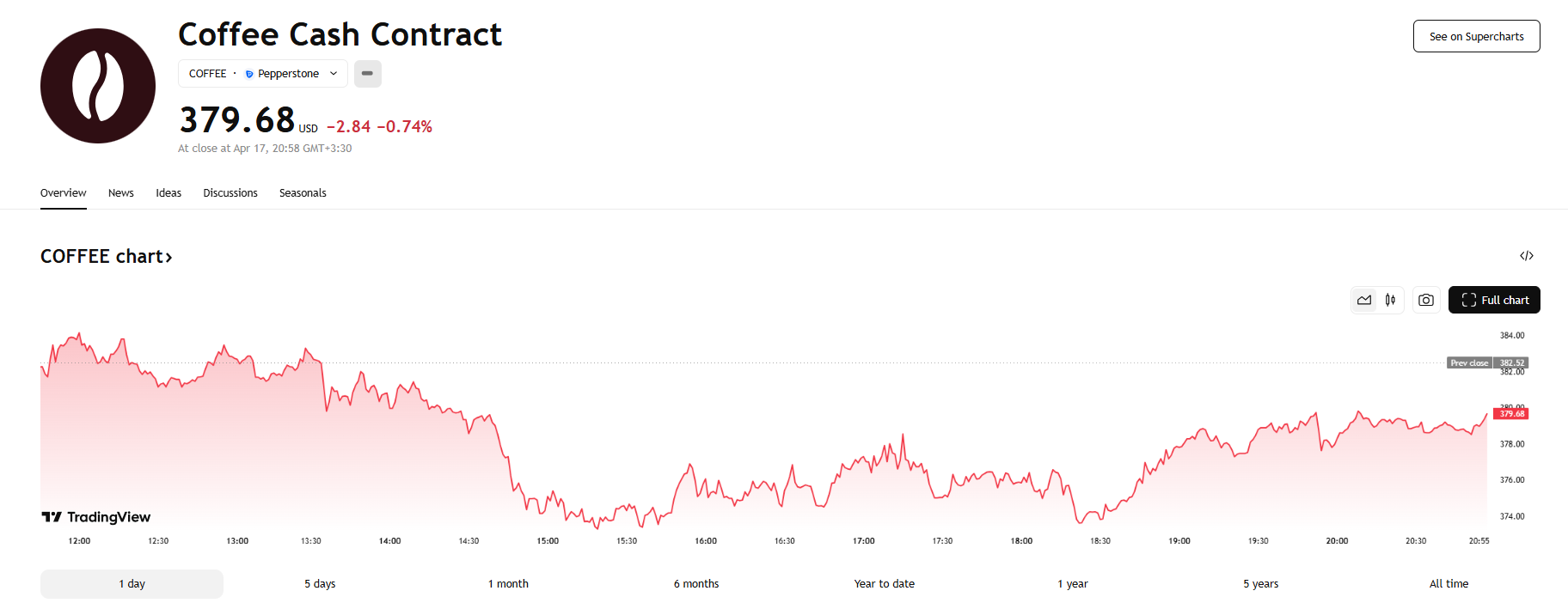

coffee Symbol price chart on TradingView

🔵Top Strategies for COFFEE Trading in Forex

- Price Action at Key Levels: Use support and resistance zones to define entry and exit points.

- Oscillator-Based Signals (RSI, CCI): Identify overbought or oversold conditions for short-term trades.

- Seasonal Fundamental Analysis: Monitor harvest conditions and crop forecasts from exporting countries.

- News Trading Strategy: React to global reports on exports, inventories, and supply chain shifts.

- Long-Term Charting: Analyze monthly and seasonal trends to identify medium-term market direction.

🔵Best Time to Trade the COFFEE Symbol

The most suitable time for COFFEE trading is during the New York session, especially between 13:30 and 17:00 GMT. This is when ICE Futures U.S. markets are active and trading volume peaks, offering tighter spreads and stronger price movements.

🔵Pros and Cons of Trading COFFEE in Financial Markets

Pros:

- High volatility provides numerous trading opportunities

- Diversifies trading portfolios with an agricultural asset

- Access to reliable fundamental data from global sources

Cons:

- Strongly affected by weather, politics, and supply chain issues

- Higher spreads compared to major forex pairs

- Sensitive to unpredictable export data and inventory reports

🔵Final Words

The COFFEE symbol in forex is an attractive trading option due to the global demand and economic significance of coffee. By understanding its trading conditions, applying the right combination of strategies, and trading during optimal hours, traders can capitalize on the volatility of this agricultural commodity.

If you’re interested in trading Coffee in the financial markets, our experts can provide you with the right guidance to access the best trading conditions.

🔵Frequently Asked Questions

What does the COFFEE symbol represent in forex?

It represents the price of coffee traded globally in USD, accessible through CFDs or futures.

Do all brokers offer COFFEE CFD trading?

No, only brokers that support commodity CFDs typically include the COFFEE symbol.

What factors influence coffee prices in forex?

Weather conditions, harvest reports, global demand, and export levels from major producers.