Forex trading platforms are tools that traders use to acquire access to financial markets. This tool allows traders to view charts, open and close Forex trades, and learn more about currency pairs. The ability to work with these platforms is critical to a person’s success in the Forex market. There are many more Forex platforms available, making it difficult to make a decision. That is why we decided to introduce the best Forex trading platforms in this article and examine their features.

What services do Forex trading platforms offer?

A trading platform is a piece of software that enables you to trade various currency pairs in financial markets such as Forex. These programs are designed to be installed on a variety of operating systems, including Linux, Windows, Mac, and mobile phones. Simply download and install these tools from the broker’s website on your computer or phone to access them. Then you should begin working with a demo or real account. The following are some of the most important characteristics of these platforms.

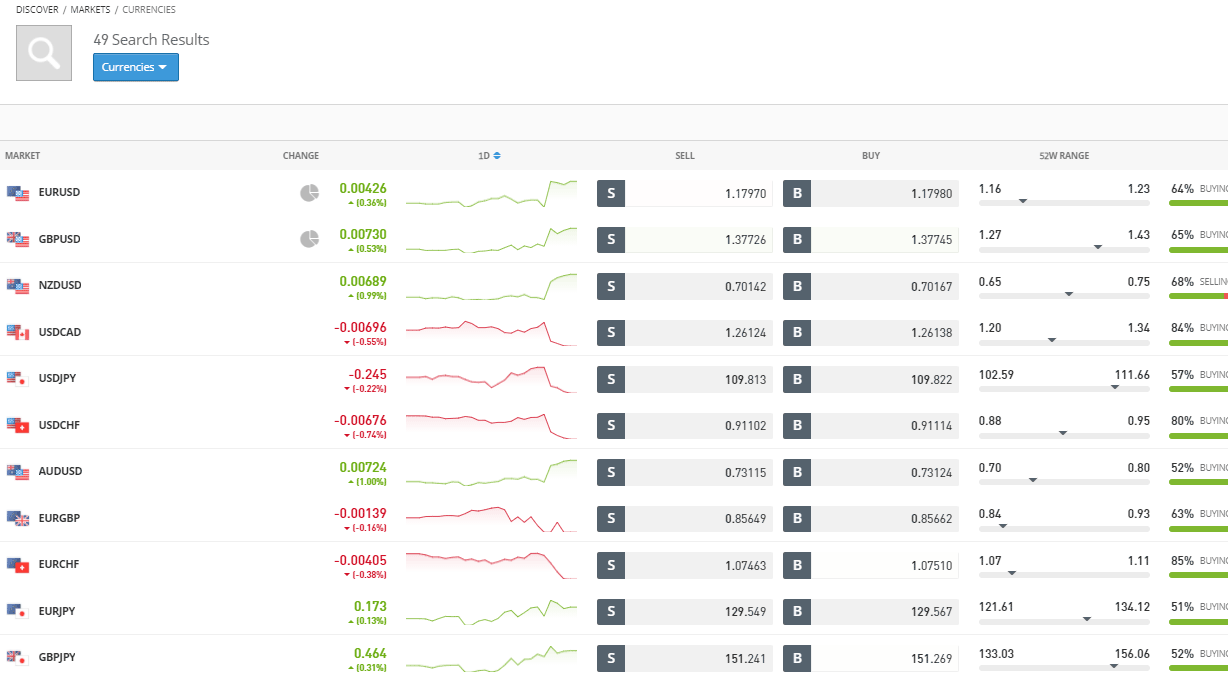

- All prices are posted online and instantly on Forex trading platforms, and you can see even the smallest changes. It also offers you the possibility to view and review several charts at the same time, apply fundamental analysis, and view current spreads

- The presence of various types of analytical tools, such as indicators, shapes, lines, time frames, and so on, will assist you in conducting the best market analysis possible.

- The Forex platform allows you to manage your transactions. This system includes features such as opening and closing transactions, viewing pending transactions, setting a loss limit, and executing trading robots.

- Some of these platforms offer their customers additional services such as newsletters, the ability to extract data in the form of Excel files, copy trading, and so on.

Of course, the above features are only a subset of the services offered by a platform. Depending on the type of transactions and goals, each system has different possibilities.

Various types of trading systems

- Licensed products: brokers purchase these products and give them away for free to their clients.

- Dedicated brokerage platform: This type of system is designed to meet people’s needs, and the brokerage sometimes sells their license and sometimes provides it to customers via White Label.

- Analytical Platforms: Some other trading systems enable advanced analysis such as automatic pattern recognition. Brokers typically offer clients analytical platforms for marketing purposes. Be aware that transactions are not possible in these systems, and they only provide analysis and review.

The type of trade you choose is determined by your strategy and goal. Customers are currently provided with at least one trading system by brokers to conduct their transactions.

What characteristics distinguish the best Forex platform?

Each platform offers its customers unique features and capabilities. But the question is, which characteristics are important, and should we pay attention to them when analyzing a system? You will learn about some of the most important of them in the sections that follow.

- The platform’s user interface should be customizable, allowing you to change control panels, charts, and colors to suit your preferences.

- Since the Forex market’s prices change in real time, the platform in question should notify you as soon as possible. Because even a small delay can cost you money.

- People use charts, shapes, and other tools to analyze various currency pairs to trade them. As a result, a good trading platform should provide you with these features. Privately developed trading systems typically have more features.

- If you analyze currency pairs on multiple platforms, such as a computer and a mobile device, it is best to choose a system that supports both.

In general, the best Forex trading platforms are those that you feel comfortable using and that meet your needs.

Introducing the best Forex platforms

Which is the best trading system for newcomers to the Forex market? Even professionals may have been asked this question. As a result, we will introduce you to platforms that have performed well thus far.

Metatrader 4

This software is a MetaQuotes product that was released in 2005. Because of its numerous advantages, MetaTrader 4 has become the standard in Forex trading platforms. Working with this software is very simple and easy, and it is completely free to use.

The automatic trading system is a key feature of MetaTrader 4. This feature allows you to incorporate a variety of trading robots, charting tools, and indicators into your trading system. Metatrader 4 is written in the MQL4 programming language, and by learning it, you can create a wide range of indicators. This platform currently includes 30 technical indicators, 33 charting tools, and 9 time frames.

Take note that this software is not modular, and you cannot have the chart floating on the desktop. To achieve this, you must reduce the overall size of the program. This system also has a section for news feeds, but the design is uninteresting.

Metatrader 5

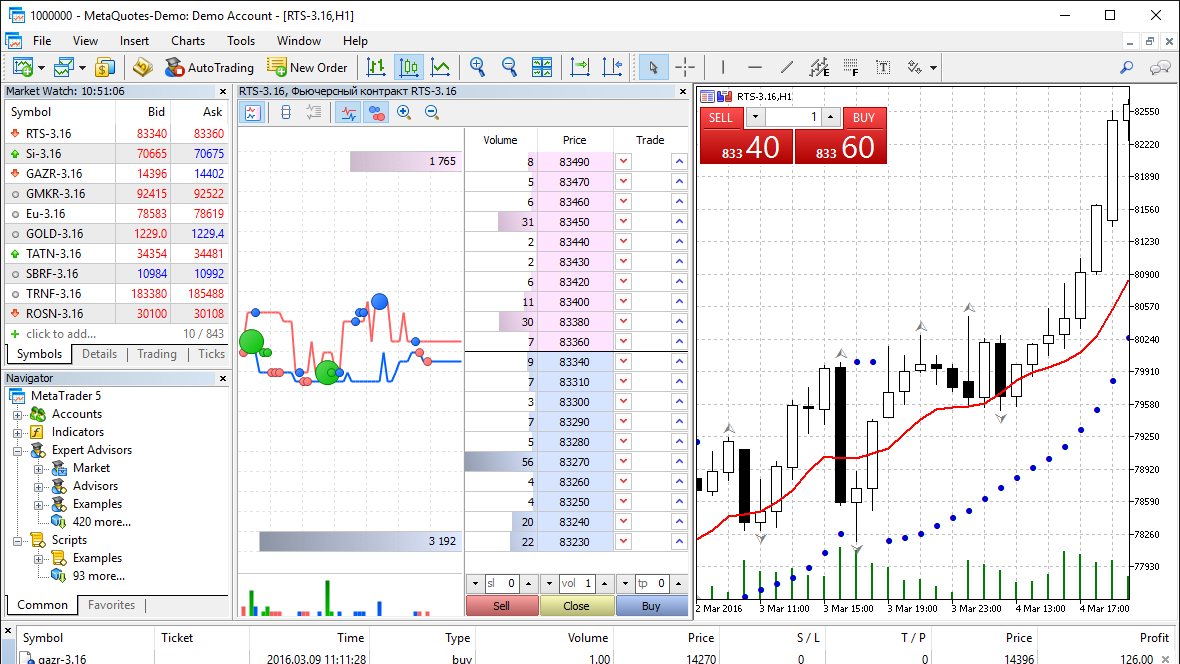

This software is an improved version of MetaTrader 4, which was released in 2010. Despite many advanced changes, Metatrader 5 was not as popular as version 4. Metatrader5 also offers customers the option of automated trading and employs the MQL5 language, which is an improved version of the MQL4 language.

This program includes 21 time frames (from a tick to a month), 68 drawing tools, and 38 indicators that allow users to perform various chart analyses as well as buy and sell currency pairs. Although this platform is less popular than the previous version, many Forex traders still use it.

XTB Forex trading system

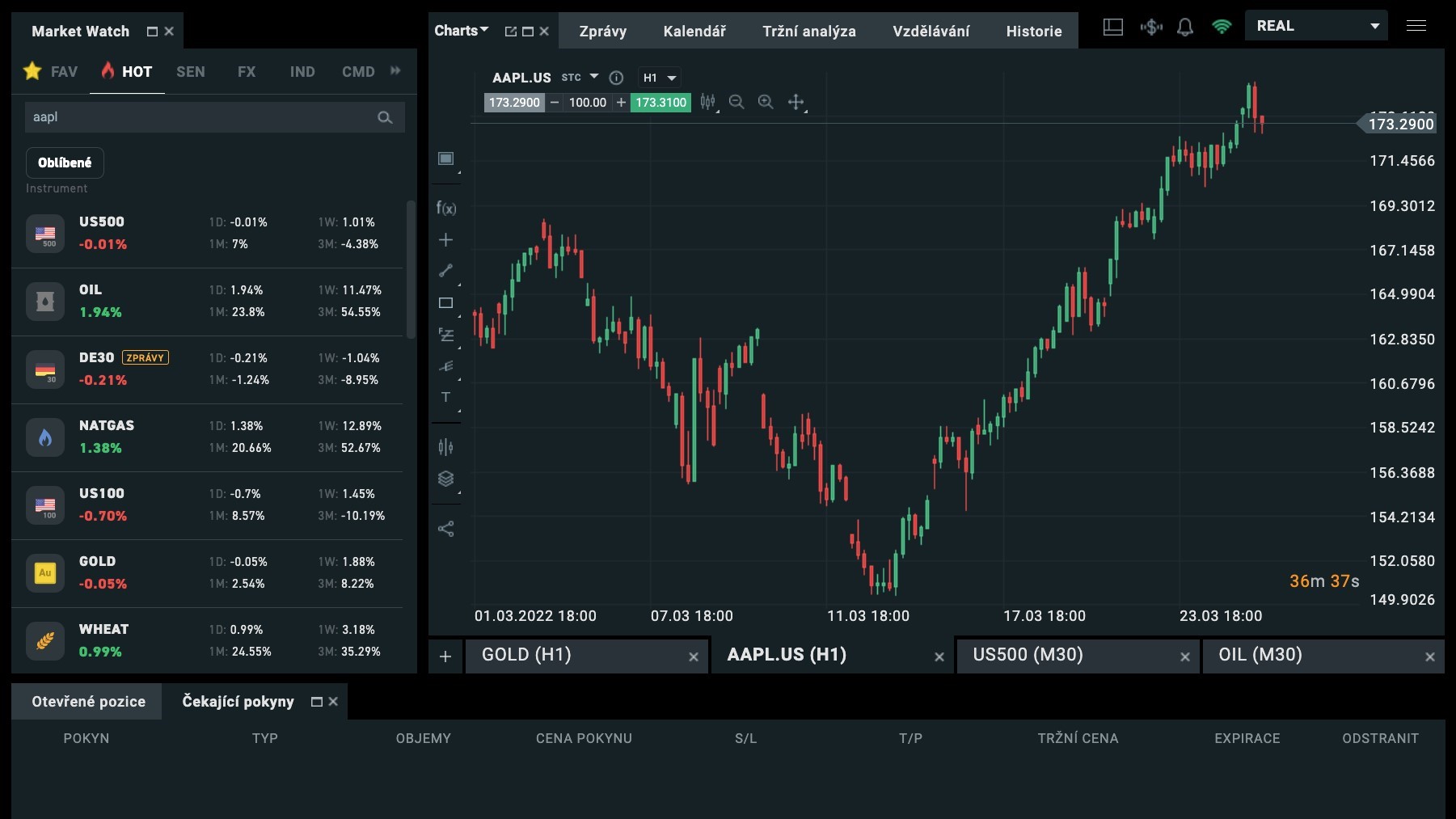

The XTB platform is another popular Forex trading platform in recent years. This software is made in Poland and is subject to Polish laws. This system allows you to trade digital currency and metals in addition to Forex. Nothing is paid in commission at XTB, and everything is included in the spread.

This system has a basic user interface and can be used from any browser. XTB also has a customer support department that answers users’ questions 24 hours a day, seven days a week. It’s also worth noting that this system supports over 1500 financial markets and offers customers a diverse range of trading options. The only drawback of XTB is the exorbitant fees imposed for CFD trading.

IG trading platform

If you do not use leverage, your daily profits from buying and selling currency pairs in the Forex market will be modest. Having leverage increases your chances of making more money; therefore, if you have limited capital, it is preferable to use platforms with high levels of leverage. The IG trading platform provides 1:200 leverage on EUR/USD, EUR/JPY, EUR/GBP, and USD/JPY currency pairs.

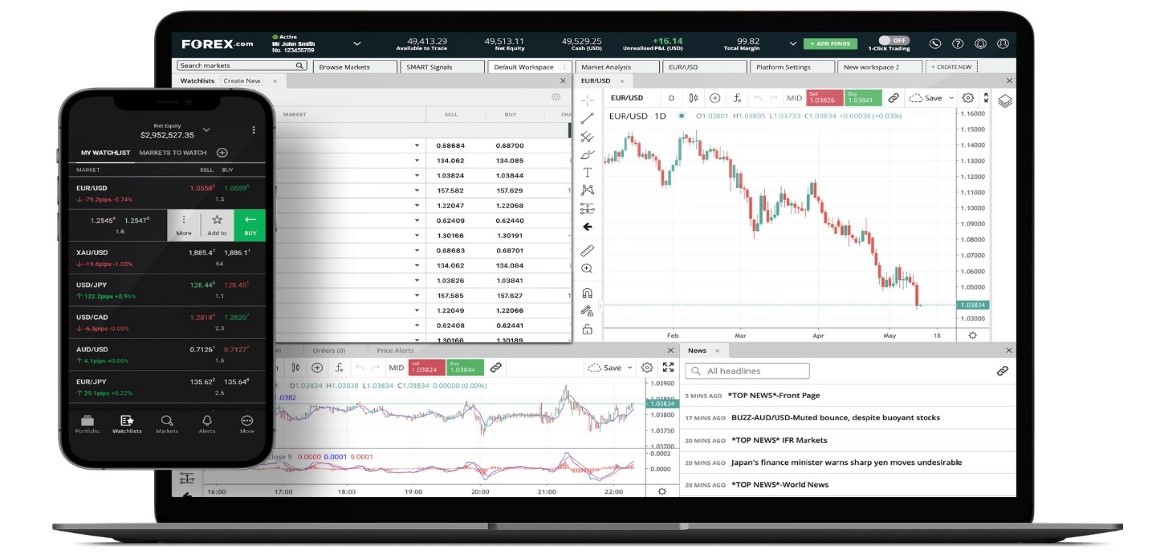

You also have access to more than 80 currency pairs on this platform, and all transactions are free of charge. This platform can also be accessed via the website and mobile application. IG is also supported by MT4, and the spread starts at just 0.6 pips. Other benefits of the IG platform include the following.

- The lowest spread in the financial market

- Opening an account in the shortest possible time

- Suitable for both beginners and professionals

- It features a sample account version for free

So, if you’re looking for a simple Forex trading platform to get started with, IG could be a good option.

CMC Markets

CMC Markets platform offers over 330 currency pairs, and in general, it includes every major and minor currency pair, from Indian rupees to Mexican pesos and Singapore dollars. This platform is compatible with all desktop browsers as well as Android and iOS operating systems; thus, you can enter this system and trade with any device.

In addition to Forex, you can trade stocks, digital currencies, commodities, and other assets at CMC Markets. It is also worth noting that this platform does not charge a commission and has extremely high liquidity.

FXTM Forex trading platform

FXTM was founded in 2011 and is headquartered in Cyprus. This platform allows you to trade Forex currency pairs, indices, local metals, and CFD stocks. FXTM is based on the MetaTrader 4 and 5 platforms and offers clients a variety of features such as transparent fee reporting, order confirmation, and price alerts.

This platform has no deposit fees and allows you to trade in four currencies: NGN, EUR, GBP, and USD. FXTM also has quick account opening, simple deposit and withdrawal, mobile and desktop applications, and free training courses.

Ninja Trader

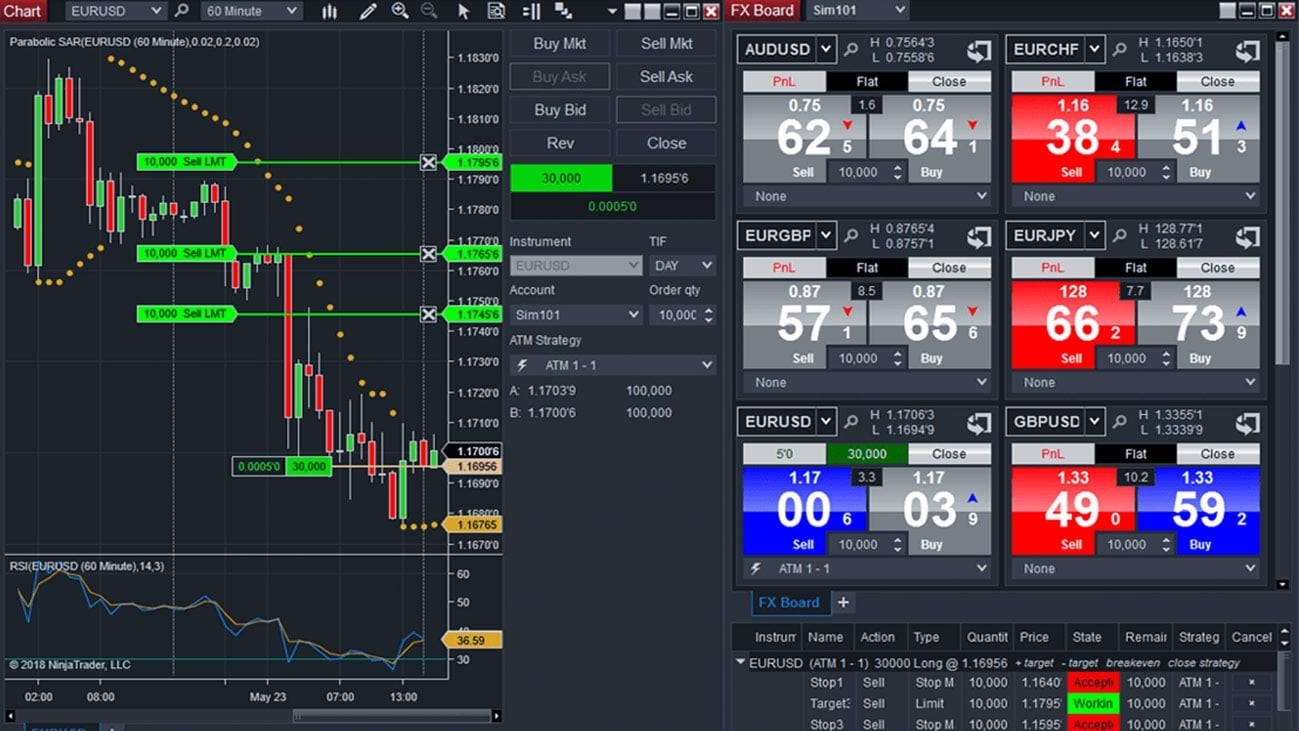

This platform began operations in 2000 and is regarded as one of the best options for professional traders looking to analyze market volume. Customers can access a variety of analytical features and capabilities through Ninja Trader. To try out this program, go to its official website and create a free demo account.

Ninja Trader is a personal platform that other brokers have purchased and licensed to their clients. This platform is written in the C# programming language, and thousands of plugins and applications have been developed for it. Other features of Ninja Trader include the ability to create separate windows in the chart, a wide range of indicators, technical analysis tools, and 37 time frames.

eToro

eToro is currently one of the largest Forex trading platforms in the world, with over 17 million customers. This platform is simple to use for Forex transactions, and you can trade without paying any commission.

eToro supports 50 currency pairs and makes money through spreads. This platform accepts electronic wallets, interbank transfers, debit, and credit cards, and you can easily fund your account. In addition to Forex, it is possible to trade digital currency, stocks, ETFs, indices, and commodities without paying a commission. eToro also has a user-friendly interface and the ability to copy trade.

A review of the three best Forex trading platforms

All of the platforms mentioned above offer the bare necessities for buying and selling currency pairs. The main distinction between the platforms may be the number of currency pairs, indicators, and time frames. Choosing the best and most reliable Forex platform is a difficult task that is dependent on a variety of factors. Everyone should select their preferred platform based on their personal preferences and strategies; some are looking for a simple user interface, others are looking for information exchange, and still, others are looking for technical indicators to experience better deals.

Keep in mind that no Forex trading platform is perfect, and each has its own set of advantages and disadvantages. You can try them all out to see which one is best for you.

Forex trading platforms are tools that enable you to trade and analyze financial markets.