The Forex market –which is a place for trading currency pairs- is considered a profitable but volatile market. Therefore, you must be familiar with the best Forex trading strategy, techniques, and tools before entering the currency market. One of the important methods of trading in financial markets, especially Forex, is finding a correct and principled trading strategy. A strategy is a plan that a trader chooses before starting a position for conducting his/her transaction. This plan includes the time of entering and exiting a transaction and the maintenance of currency pairs.

There are a lot of strategies for trading in the Forex market that traders use for conducting transactions and achieving their goals. Selecting a strategy for a trader based on his goals, personality, and funds helps a lot with creating order in this business. That’s why in this context we are trying to familiarize you with the various types of strategies that exist in the currency market and help you choose the best trading strategy in Forex.

What is a Trading Strategy?

A trading strategy is a program that uses analytics to identify specific market conditions and price levels. By using this strategy, you will form a specific and functional program for yourself based on your personality, financial status, goals, and time. So, during all activities and transactions in the market, you will use that strategy as a guide in your way.

A strategy consists of the best methods for estimating price movements and the rules about entering and exiting a transaction. However, some people mix up a strategy with trading style. Although there is a lot of confusion between trading style and strategy, there is a main difference which we are going to describe in the next section.

What is the Main Difference Between Trading Strategy & Trading Style?

Every trader must be informed about the difference between trading strategy and trading style and not mix these two up. A trading style is a general plan for transactions, determining the amount of repetition for a transaction, and the duration of maintaining a position, while a strategy is a very specific method for determining the exact time for entering a position at a certain point and exiting at another one.

In other words, trading style is the trader’s preference such as the number of conducted transactions and the amount of time for holding a position. A trading style can be changed based on the market’s conditions and your desire to maintain or exit a position.

Sub-types of Trading Strategies:

There are different trading strategy types and we will illustrate their way of function in this part. Due to the magnitude and volatility of the Forex market, different types of strategies have to be considered for each situation to achieve the best outcome. When a trading strategy is implemented step by step and with principle, it helps traders to achieve their desired results. In the part below we have named some of these strategies:

- Trend Trading

- Range Trading

- Scalping

- Breakout Trading

- Reversal Trading

- Gap trading

- Arbitrage Trading

- Momentum Trading

Now that you have been familiarized with the sub-types of trading strategies, it is time to describe them. In the upcoming parts, we will explain each one of them individually and vastly for you.

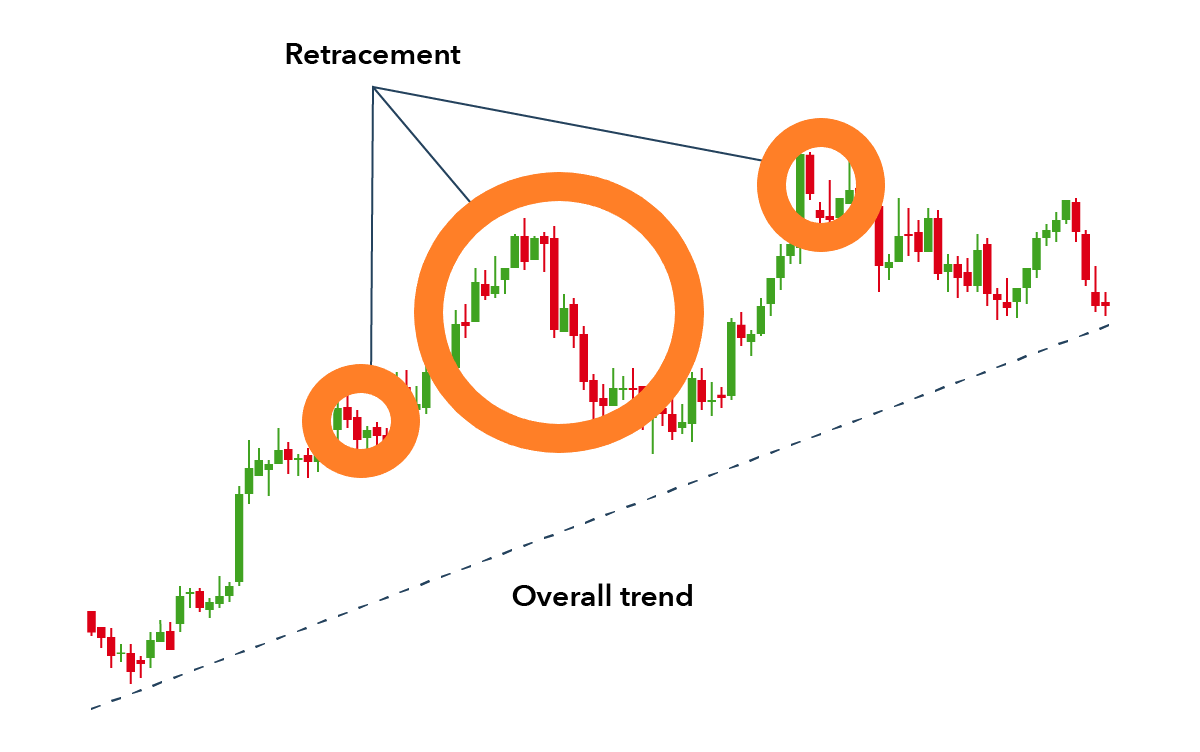

Trend Trading:

Trend trading is a kind of trading strategy, based on using technical analysis, used for determining the direction of the market’s price movements. Trend strategy is usually considered a medium-term method that is suitable for the trading methods of oscillator traders. In this strategy, every position remains open until the market trend continues. By using this strategy, the trader believes in the upward trend of the market while buying and selling a new position.

Therefore, by using technical analysis, the trader predicts that the market’s prices will reach their maximum state. In Trend strategy, leverages are one of the most popular choices among traders. However, be sure to use the proper risk management while using these high-risk leverages so that you don’t suffer any financial loss. To use the Trend strategy, you also need to be familiar with the most popular technical analysis tools. These tools include Moving Averages, Relative Strength Index (RSI), and Average Directional Index (ADX).

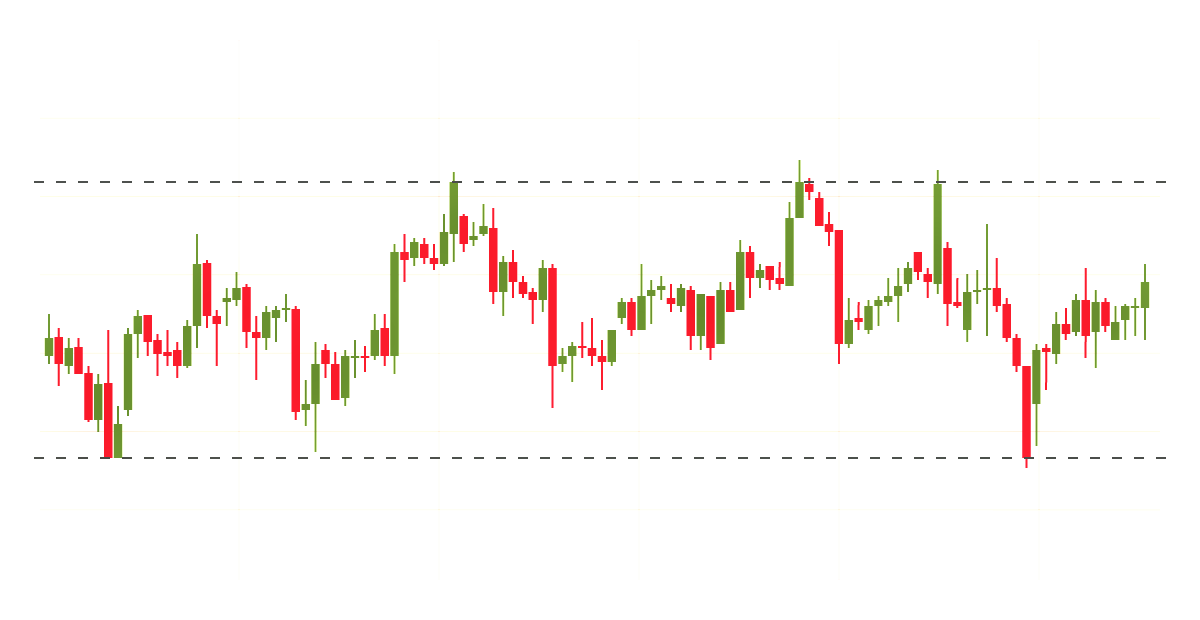

Range Trading:

In the Range strategy, the trader’s goal is to make a profit from the integrated status of the market. This kind of strategy is used when the prices in the market remain in the support and resistance lines. The popularity of the Range strategy is due to its emphasis on short-term profit. However, the Range strategy can be used in all kinds of styles and periods, while in the Trend strategy, the traders focus on the general tone of the market. The centrality of the Range strategy is based on short-term fluctuations in the market price. The traders open their buying position, while the price is moving between two smooth levels and does not have any breaks at its top or bottom. In other words, a property is bought in the uptrend of the market, and it is sold during the downtrend with the assumption that the price will continue to decrease.

Scalping:

The shortest transaction time can be found in the Scalping strategy and the positions will only be open for a few seconds or moments. The Scalping strategy targets small movements in daily market prices. The purpose behind the Scalping strategy is to conduct a lot of transactions with low profits very fast, so adding up all the small profits made in one day together, the trader will gain a lot of profit. In the Scalping strategy, a high amount of successful transactions in one day will result in a lot of profit for the trader.

Considering that in this strategy there is a need for cash markets and low spreads, therefore the Scalper traders tend to trade the major currency pairs due to their high liquidity and extensive amount of transactions. Also, traders tend to trade in the most crowded trading time because, at that moment, there will be various fluctuations in the market due to the great number of trades.

A trader also pays attention to another thing while using the Scalp strategy, and that is the minimum amount of spreads in an exchange store. Because of the numerous positions in one day, the trader’s profit would decrease if the spread cost is high. Although the scalping strategy has a lot of advantages, one of its disadvantages is creating high stress and tension among traders. Therefore, people who cannot manage their stress should not choose this method.

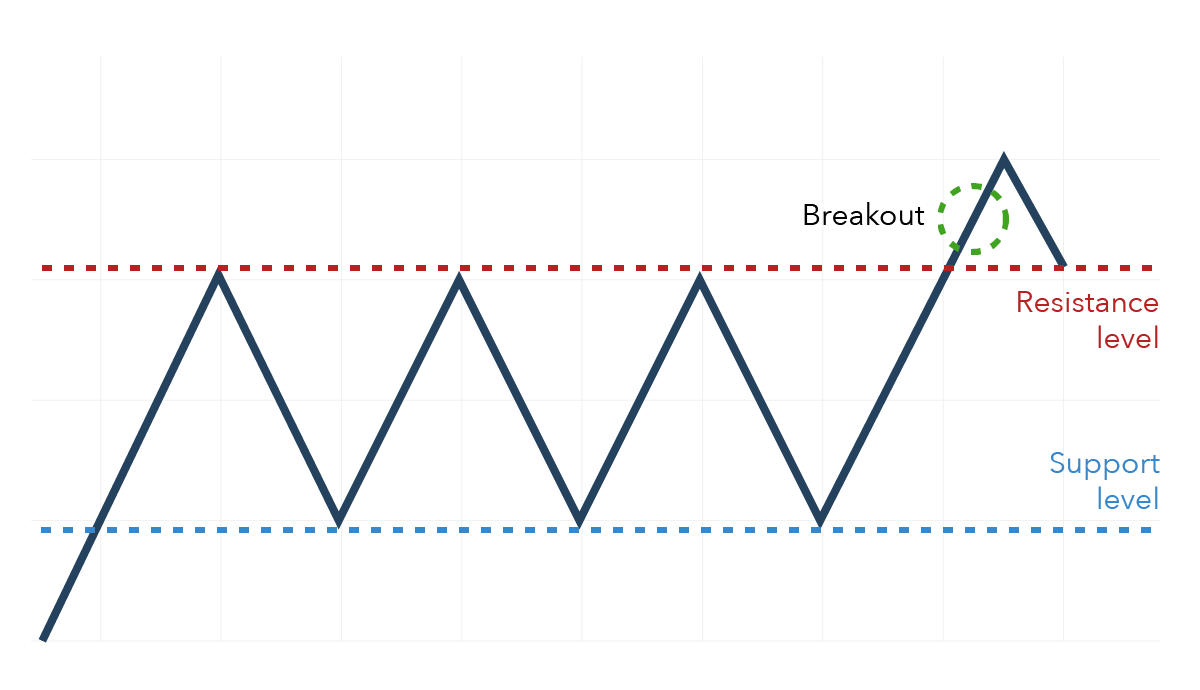

Breakout Trading:

The Breakout strategy includes buying and selling a property after the break of an important price level such as the support level or the long-term resistance of the stocks. The breaking of the resistance level and its selling takes place after the breaking of the support level.

The technical analysis strategies such as opening the range, dual drift, and patterns like flags, heads, shoulders, and tringles, all fall under the category of breakout strategy. The traders that use the Breakout strategy are looking for price points like a fluctuation period or emotional changes in the market. By entering the market at the correct point, using the Breakout strategy, traders can then continue to move the position from the beginning to the end of the level.

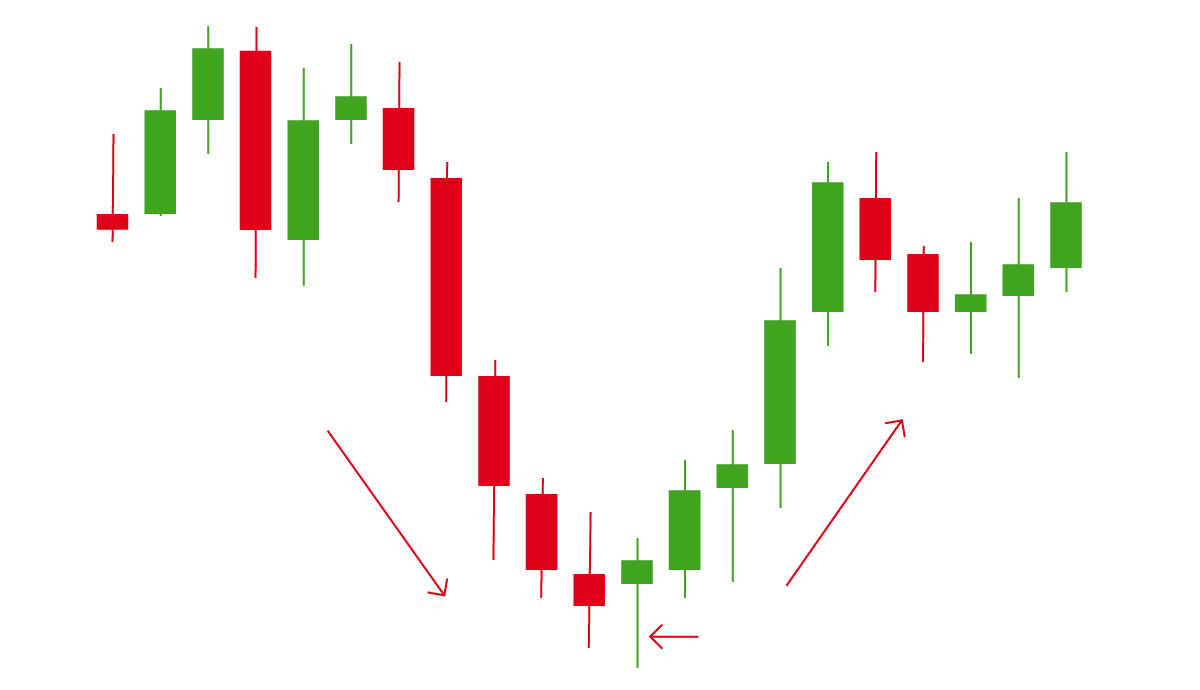

Reversal Trading:

The Reversal Trading strategy is based on determining the time of change in the current direction of the price movement for a certain property. According to this strategy, the financial market reacts greatly to the news and global events and the foundation of transactions. The Reversal strategy is also the extent of the market’s reaction to the news.

For using the reversal strategy, first, the trader should analyze all the important global news, and then understand the market’s tendency and way of price movements due to the available information. The method of trading with this strategy is that if the trader observes an increase in a stock’s value and a low number of buyers for it, he will calculate its profitability. Therefore, according to the market’s tendency, the ratio of the buying and selling position, and personal knowledge, a trader conducts a transaction by using the Reversal strategy.

Gap Trading:

Using the Gap strategy is preferable during the market’s inactivity because, after that, the price of a property will suddenly increase or decrease. In other words, when the price of a certain property suddenly goes up or down after closing its last price, the Gap strategy can be used.

The Gap dealers are often daily traders who are vigilant of the price gaps from the day before. Now by using the gap strategy, traders are waiting for a good opportunity in the trading period between the previous day and the next day.

Arbitrage:

It is a trade or a group of trades in which the trader profits without taking any risk. In this strategy, the trader profits from the price difference of a certain property. Arbitrage is a short-term strategy that is perfect for people looking for low-risk trading. In Arbitrage, the trader doesn’t need to use analysis and various complex techniques and he/she can easily make a transaction. Some of the Arbitrage disadvantages are low profit and different fees at every exchange store. Trading opportunities disappear fast in the Arbitrage method because the short time, a lot of dealers rush to the market to make a profit.

Momentum Trading:

The Momentum strategy includes investing in profit from the current moving trend of the market’s price by increasing or decreasing the price. In this strategy, one’s attention is directed toward the tendency of a continued price trend before it gets cut by an external factor. The transaction will remain open in the Momentum strategy until the price changes. Momentum illustrates the rate of changes in price in a certain period so that the traders can understand the strength of the price movement.

What is the Best Trading Strategy in the Forex Market?

Trading in financial markets, especially Forex, has no specific method that would apply to everyone. No trader will have the same strategy as another one. To reach a compatible strategy, you should be completely familiar with things like the tendency towards taking a risk, your trading style, and your motivation. Choosing the right trading strategy for each person depends on that person’s characteristics, stress management, overview, initial fund, and knowledge.

Each person can use all these mentioned strategies if they enter the Forex area with the proper knowledge. Therefore, each person can find his/her own best Trading strategy in Forex. Always research as much as possible before entering such fluctuating financial markets as the Forex market. In addition to that, be sure to use a virtual account before entering the main market to put your capabilities, personality, and stress level to the test.

What Should You Know Before Applying Your Trading Strategy?

There are a lot of differences between planning and executing a program. Therefore, you should be aware of the amount of time that you are going to dedicate and the necessary sacrifices while executing your plan. Before starting the main transactions, you can challenge yourself by using virtual accounts. By doing so, you will enter the financial market with more awareness in addition to preserving your fund and preventing losses.

In virtual accounts, you can receive up to ten thousand pounds as a virtual fund and you can easily execute trading strategies. In addition to this, you can use a demo account as a great opportunity for exploring markets and practicing the daily habits of a trader. After you have been properly introduced to the financial markets using demo accounts, you will enter the main area –the fluctuating world of Forex- with more knowledge and wisdom.

Final Words:

In this context, we struggled to share information about “What is the best trading strategy?”. We understood that there are various types of trading strategies in Forex. We have also been familiarized with different methods of strategies that were possible to be used by the traders. We learned that the best trading strategy in Forex depends on a trader’s personality, fund, goals, and time. Some of the strategies were based on stress management and some others needed some daily time dedicated to themselves. There is also the possibility of applying various strategies at the same time for different transactions if the trader has enough knowledge about the market’s condition, analysis, and techniques, and also has proper knowledge about understanding strategies.

Therefore, due to the various types of personalities and goals, the same thing cannot be prescribed to every trader. According to his/her condition and knowledge about his capabilities and knowledge about the Forex market, each trader must choose a plan and a strategy compatible with his transactions. In addition, all the paths will not lead to success. In all these strategies there is still some risk and you should decide vigilantly.

FAQ:

- What tools are needed for applying a strategy in Forex?

The necessary tools for executing Forex strategies include charts, fundamental or technical indicators, news and information about the market, etc.

- What are the disadvantages of using the momentum strategy?

The biggest problem with the momentum strategy is its large fee and its periodic 24-hour observation of the market.

- After choosing a strategy, what factors are necessary for continuing the transaction?

The amount of initial funds for starting a trade, risk management, and the type and method of exiting a position are necessary for continuing a trade in Forex.